The global banking landscape is transforming rapidly, driven by new tech trends and growing customer demands. It’s impressive to see how swiftly banks and financial institutions are integrating the latest digital banking trends into their strategies.

Modern fintech organizations, well-informed and responsive to change, are different from traditional banks. But industry shifts and growth have no limits. Banking trends are emerging with lightning-fast speed, from AI and virtual assistants to more advanced security and sustainability – these are digital transformations that financial companies can’t ignore.

Of course, banks have the right to stay conservative and committed to traditional values. But if they want to skyrocket in the banking sector, embracing new trends in digital banking is a must.

Brett King has already predicted a digital future for the financial vertical, implying that banking without banks will be our new reality. “At 2030, I would say that you probably have two billion people that’ll be using day-to-day banking services, independent of banks.”

So, where is the banking market heading in 2024, and what innovations are waiting for traditional banks and fintech companies? Let’s dive into key digital banking trends to consider in 2024 and get ready for the future of e-banking.

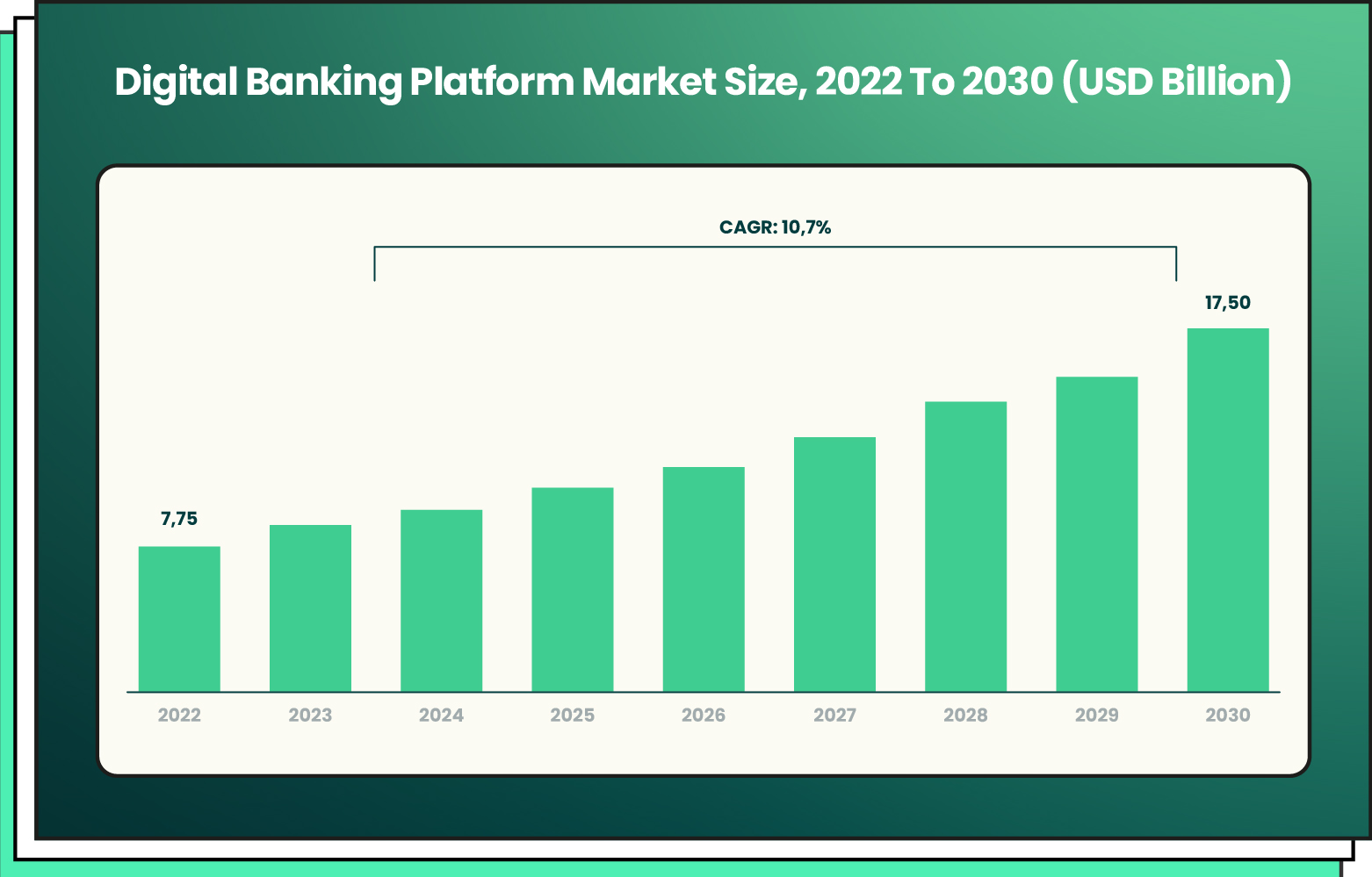

Digital Banking Platform Market Size

According to the Vantage Market Report, the global digital banking platform market was valued at $7,75 billion, projected to reach $17,50 billion by 2030. Plus, the annual growth rate can reach over 10%. Sounds promising, but what has contributed to this sudden growth?

The main factors fueling the growth of the digital banking platform include digitalization, technological advances, ease of banking, and customer-centric financial solutions.

However, the rise of the digital banking industry has also been caused by challenges like COVID-19 and cyber attacks. If pandemics boosted the adoption of digital banking platforms, the increasing incidence of cyber-attacks has contributed to the emergence of new security measures. Even banks having online applications understand that the adoption of new digital banking trends can bring more to the table.

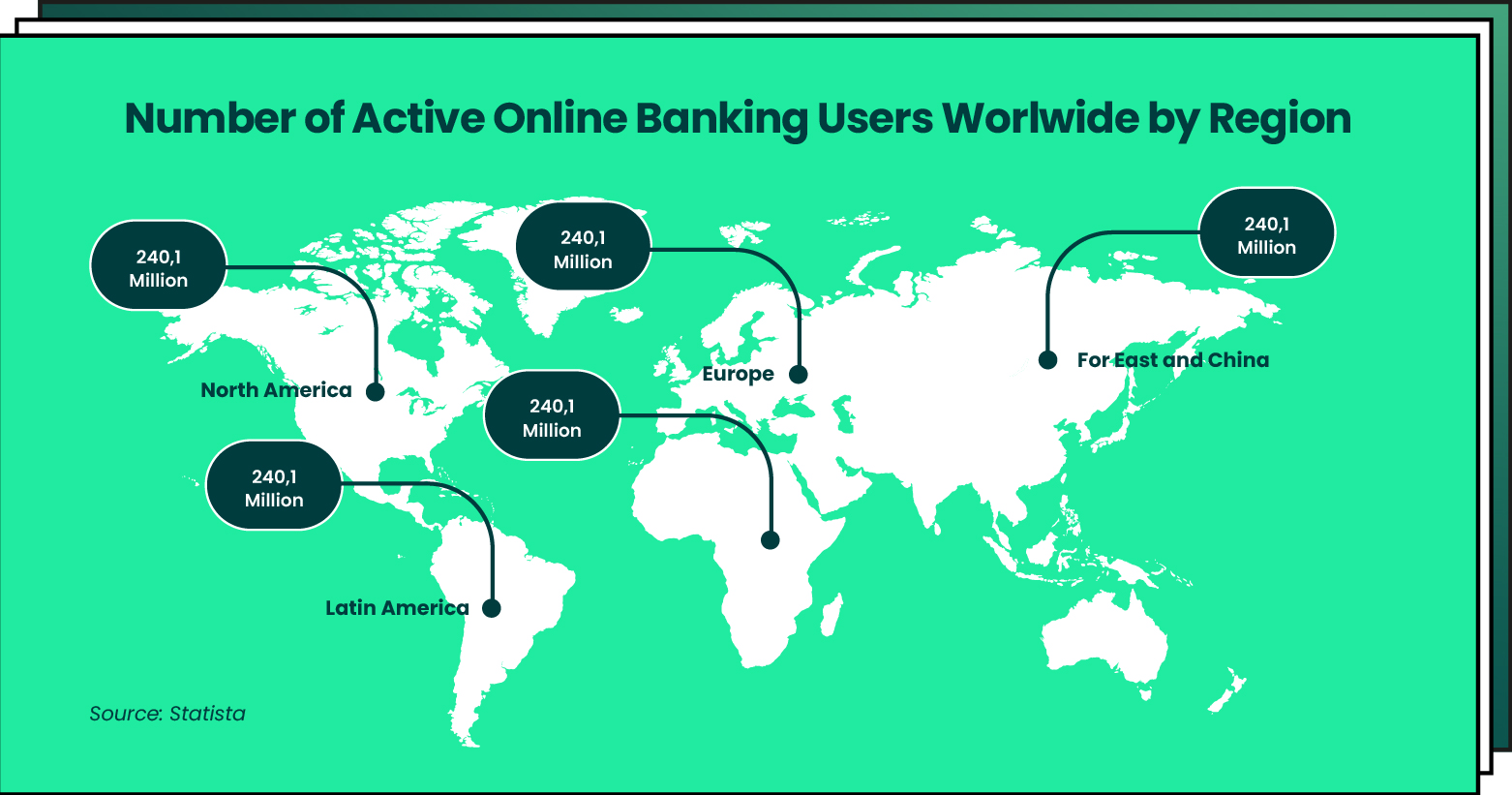

When talking about country segmentation, Asia has the largest number of online banking users, 805,1 million. When it comes to market share, North America occupies a leading place with 37, 3% and a net worth of $2,9 billion. But Europe is also a region where digital banking businesses prosper.

Digital Banking Trends to Consider for Your Business

The traditionally stable banking sector can’t stand still. This opens the door for the following innovations and transformations.

First, the emergence of cloud and AI encourages banks to integrate cutting-edge tech. Second, changing customer expectations result in hyper-personalization, real-time insights, and data-driven decisions. Finally, fierce competition from fintech and big tech drive drive banks to innovations.

So, let’s delve into the key banking industry trends in 2024 that will impact banks and assist in resisting throat-cutting competition.

Generative AI for advanced banking services

Generative AI is making waves in finances with its ability to learn from expansive datasets. The value of this digital banking trend is that it takes a step further than Robotic Process Automation (RPA) by adapting to changing scenarios, identifying patterns, and analyzing historical data. From AI-powered chatbots to personalized services and advanced fraud detection, all these solutions have a powerful impact on the banking sector.

With its capability to craft human-like text, generative AI is shifting to conversational finance, allowing the use of data for instant and personalized insights. Thus, financial institutions are integrating conversational AI into their chatbots and virtual assistants to inform about payment notifications and offer bespoke financial advice and quality customer support.

Another benefit of generative AI for banking is the integration of algorithmic trading. According to the latest research of Spherical Insights, the global algorithmic trading market was valued at $ 13,02 billion and is expected to reach $31,30 billion by 2030. Plus, the growth rate is 13,6%. So, generative AI is one of the aspects contributing to the industry’s growth. Simply put, the integration of generative AI in banking promises more quality trading decisions, enhancing investment strategies and portfolios.

For example, JPMorgan Chase implemented an AI program to automate the interpretation of commercial loan agreements. The value of this solution is that it processes documents in seconds, saving lawyers’ and loan officers’ time and effort.

Chatbots and virtual assistants for personalized banking services

The integration of chatbots and virtual assistants is one of the top banking industry trends, moving the personalization of banking services to new heights. From investment recommendations to tailored finance advice, AI is transforming customer support and interactions.

First, AI-powered chatbots and virtual assistants offer personalized aid by facilitating transactions and providing relevant information. What’s more, they consider individual financial situations before offering recommendations. Second, AI chatbots make banking smarter as automated answers to FAQs, reduced call center volume, and more free time for staff are becoming the norm in banking apps.

As a result, AI-powered virtual assistants are helpers for digital banks who can bear responsibility for interaction with clients, allowing banks to keep pace with customer expectations and preferences. Finally, chatbots contribute to reducing the workload for employees and increasing customer satisfaction.

Secure authentication for protecting sensitive information

The digital banking trend of secure authentication is a necessity rather than a tech tendency. The main reasons why this tendency is widespread are the increase in security risks and the need to protect sensitive information.

Hence, the demand for digital identity verification checks is rising, prompting the use of more advanced methods for secure authentication. For example, biometric verification methods for online banking are effective against fraud. Biometrics in banking does not only protect data but also saves the time necessary for approving transactions. Additionally, based on digital identity solutions, banks tend to use intuitive interfaces for the verification process based on digital identity solutions.

With all the advanced tech comes the need for extra protection. That’s why digital identities and unique authentication are the ways banks protect users’ sensitive data and give them control over it.

Cyber security and fraud detection & prevention for reliable financial operations

Cyber security and fraud prevention are not only digital banking trends but also key goals that financial institutions pursue. So, how can we detect and prevent fraud and ensure reliable financial operations?

AI-driven fraud detection systems assist in identifying suspicious activities in real time. Plus, they also flag potential fraud for further analysis and investigation. Thus, AI cyber security systems can not only detect but also prevent possible cyber threats.

To process sensitive data flows, it’s necessary to automate fraud detection and response workflows. Together with AI-driven fraud detection systems, automated fraud techniques will ensure the reliability and security of financial operations.

Open data in banking for enhanced customer experience

Open data is a mobile banking trend that is picking up steam. Banks are embracing this concept, allowing third-party providers access to customer data via APIs and assisting consumers in seamlessly paying for their purchases. Additionally, the open data concept is one of the aspects considered while building digital banking architecture with maximum benefits for a company.

By adopting open data, banks improve customer experience by providing users more control over their financial data. Plus, it stimulates innovation, elevating banks to a new level. Finally, this is a great way to foster transparency and trust between financial institutions and their clients.

For example, Monzo is a UK app-based online bank with over nine million users. It shifted from typical retail banking practices towards openness and transparency. As a result, this bank has proven that with open data, financial institutions can quickly grab market share.

Sustainable banking for responsible business

Positive image and reputation are also business priorities that can’t be ignored. As the global community is concerned with the environment and its protection, sustainability has emerged as a banking trend gaining traction. Sustainability has become a core value that reflects a bank’s social responsibility. Additionally, banks aim to communicate eco-friendly practices to their clients and their impact on the environment.

Digital platforms are efficient tools for fostering environmentally responsible financial practices. Firstly, it’s possible to achieve this through eco-friendly investment portfolios. Secondly, digital platforms enable carbon footprint tracking. Thus, commitment to sustainability impacts customer loyalty, brand reputation, and competitive advantage in the market.

For example, such banking solutions like Bunq and Tomorrow are already committed to the green financial initiative. This collaboration between fintech and climate tech is a step towards sustainable banking.

Gamification for users’ engagement

Blending gamification techniques into digital banking services is one of the trendy things in banking, driving clients’ engagement and activation. The gamification of customers’ experience in banking turns financial tasks into fun and rewarding activities. What’s more, it keeps clients interested and involved in digital banking platform use. For financial institutions, gamification is a tool for the delivery of bespoke experiences and education of users about their product offerings and features.

For example, while using banking apps, users can earn points to measure and reward progress. Thanks to earning points, users can see their achievements related to their finances. Establishing levels is another option of gamification that visualizes a user’s path in their journey. Avatars enable customization, allowing users to decide how to present themselves online.

Monobank is a Ukrainian digital bank with over seven million users. This financial institution uses gamification to interact with their clients and encourage them to complete tasks such as making transactions with ApplePay or updating their profiles to earn badges. As a result, Monobank users can receive exclusive rewards and benefits.

Big data and analytics for targeted services

The focus on big data and analytics is another digital banking trend, allowing for providing more personalized services. With big data, banks can put customer behavior at the very center, using them for market segmentation and cross-selling. When it comes to predictive analytics, banks use it to improve sales and maximize customer acquisition efforts.

In the future, the way businesses manage to transform digitally and learn from their customers will influence their growth and success. With big data and analytics, banks will know more about consumer behaviors which can help them develop tailored products and services as well as offer personalized discounts.

Digitalization of money for facilitating payments

The emergence of various forms of digital payment methods is a way to digitalization of money, aimed at facilitating payments. Today, one of the most widespread digital banking trends is transforming traditional currencies into digital formats. What will users get? Expansion of financial accessibility, easy payments, and reduction of transaction costs are the outcomes of the digitalization of money.

To embrace this revolutionary shift, it’s vital to take these steps. First, it’s necessary to facilitate the integration of digital money and prepare for business processes. Second, it’s recommended to automate currency conversion to ensure compliance with legal regulations. Finally, it’s necessary to create and manage digital money wallets for individuals and businesses.

Regtech for handling legal compliance

Navigating regulations in banking can be a challenging process. When companies fail to comply with regulations face criminal charges, reputation damage, and hefty penalties. Regtech solutions are good ways to streamline regulatory compliance processes and adhere to laws more efficiently. The value of regtech is that it helps companies generate real-time and cost-effective solutions from risk and compliance units.

This digital banking trend has become a game-changer for banks and financial institutions in managing compliance risks and automating compliance processes. Regtech solutions are used across various financial services functions, including, transaction monitoring and auditing processes, online identity verification, risk management, and regulatory compliance and reporting.

Final Thoughts

All in all, the fintech landscape is evolving to adopt new digital banking trends and meet the changing needs of consumers. From more advanced security measures and generative AI to gamification and regtech, these trends are shaping the future of the banking system by making it more personalized and accessible. All these trends pave the way for a more edge-cutting, integrated, secure, and sustainable banking future where tech and finance are a perfect match.

At Forbytes, we’re committed to digital transformation to fuel your business with new tech trends and build efficient and user-centric solutions. We offer fintech software development services to digitalize the work of your company and enhance your performance. We provide solutions for banks, funds, credit unions, trading companies, and other financial institutions

As a finance & banking software engineering company, Forbytes is capable of expanding the functionality of your software, improving security, and adding third-party integrations for you to manage all your financial operations securely under one roof.

If you want to embrace top digital banking trends, Forbytes is at your service. Having expertise in finance & banking, we can become your reliable partner and turn your idea into a stunning fintech solution. Just contact us to start our collaboration!

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?