“Why did the bank director become an actor? He loved playing different roles, especially a safe one.” It’s funny when it doesn’t relate to you. Unfortunately, when it comes to digital banking security, it’s both laughter and sin. Using online banking services, we can’t be sure about the reliability and security of financial operations. What’s more, the core banking system architecture is often not enough robust to address the emerging threats.

According to Statista, in 2022, there were reported about 1,829 cyber incidents in the global financial industry. The situation was better than the previous year when the number of data breaches was more than 2,527. But it still shows the vulnerability of digital banking software and the need for secure and reliable solutions.

That’s why we’re here to help you make the right decision and avoid mistakes on your journey. Keep reading this post to discover the right banking system design, security requirements, and important third-party integrations, based on our expertise.

Business Context of Digital Banking: Quick Overview

What is the primary aim of the digitalization of banking? First, it involves a shift from traditional banking to a more advanced online model. Second, the digitalization of banking is done to build reliable and safe solutions to earn the trust of clients. Finally, it aims to make banking services more convenient without the need to visit brick-and-mortar banks.

More and more digital banking startups are emerging today, driving changes in how banks operate and practice innovative and advanced things. But it’s still challenging for them to excel in terms of customer experience. So, building banking software with a robust digital banking architecture is a good strategy to stay strong in the financial market.

Now it’s high time to understand how to build a core banking system architecture to ensure the security and reliability of the software. So let’s start with types of architecture to opt for the most relevant one.

Types of Digital Banking Architecture

Layered and microservices-based architectures are the most common core banking system architecture types. That’s why it is crucial to reveal their key features, strengths, and weak points to make an informed choice and build an exceptional fintech solution. So let’s begin with a layered architecture.

Layered architecture

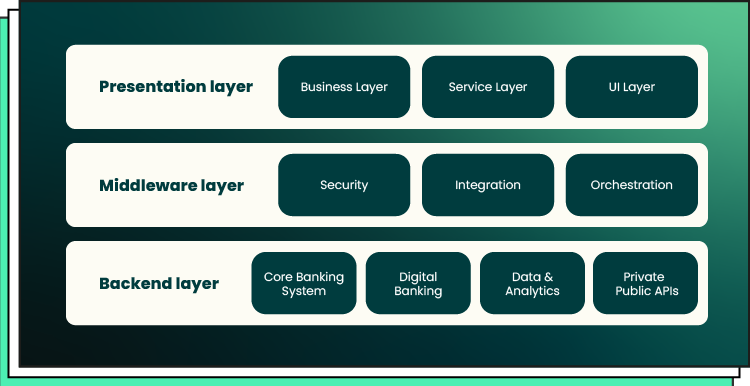

A typical layered architecture consists of the presentation layer or front end, middleware, and backend. Its key features include modularity, scalability, and maintainability, enabling easy updates and the addition of new features.

Each layer of this architecture represents a specific module, making it easier to develop. Additionally, each layer can be scaled independently. Finally, it’s possible to upgrade one layer without affecting the others.

The advantages of this digital bank architecture include easy development, clarity, and simplicity. That’s why it can be used for building large and complex banking solutions, upgrading existing ones, and adding new features.

The weaknesses of a layered architecture relate to performance overhead and rigidity. Communication between layers can require extra work for setting up and performing functions. What’s more, the layered approach is usually rigid, creating difficulties in making changes in one layer.

Microservices-based architecture

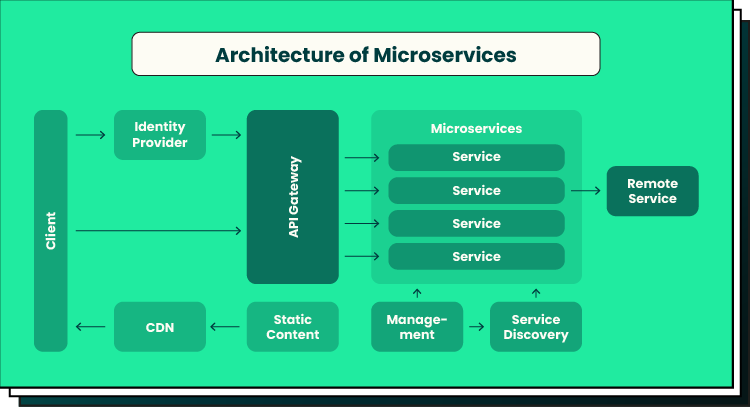

Microservices-based architecture is a collection of independently deployable services. Each service performs a specific business function and interacts with other services. Many digital banks build their banking software using a microservices architecture. So, let’s explore why it’s so popular.

The value of microservices is that they offer the greatest scalability opportunities, allowing for seamless integration with many third-party services. This architecture is the right option for you if open banking is your focus. Additionally, this digital banking architecture provides more flexibility as you can add new functionalities or enhance existing ones.

But if you don’t plan to scale up your solution or just start building banking software, it will be challenging to maintain microservices. Plus, this architecture is complicated especially in terms of data management and testing.

That’s why you should weigh all the pros and cons when opting for a digital banking architecture. Your choice depends on your goals and your vision of your software. A microservices architecture belongs to the most flexible and adaptable option. But, you may also want to combine two architectural types to better respond to your needs.

After selecting your core banking system architecture, another important step is to ensure its security. Let’s see how you can do this.

How to Ensure the Security of Your Digital Banking System

As security is one of the major clients’ concerns, we’ll share how to create a truly reliable and safe banking system. What’s more, we want to remind you that digital banking may be subject to different requirements. So don’t forget to monitor compliance regulations to modify your security measures timely.

Data encryption for data confidentiality

To mitigate risks and ensure secure storage and transmission of users’ data, use government-approved encryption algorithms. Keeping sensitive private data encrypted is a solid way to guarantee data integrity and confidentiality at all stages. But the main thing here is to follow the latest encryption practices and reliable standards. This way, you can be confident in protecting users’ personal and financial information from manipulation, fraud, and unauthorized access.

Multi-factor authentication (MFA) for extra security

To guarantee an extra security level, implement multi-factor authentication. This method combines a user’s password and a one-time code sent to their phone. MFA can include users’ biometrics or verification according to time and location. It means that if one aspect is compromised, other layers of security will assist in protecting a user’s account. By implementing MFA, financial companies can prevent data breaches and avoid damage to their reputation.

Know Your Customer (KYC) and Know Your Business (KYB) for mitigating risks

Integrating KYC and KYB is another way to conduct financial transactions with minimum risks as they oblige fintech companies to verify the identity of counterparties. Simply put, this system analyzes users’ data to detect breaches at early stages. As a result, KYC and KYB principles can serve as risk management instruments within the banking system.

Fraud prevention department for detecting suspicious transactions

To detect and prevent cyber crimes, it is recommended to establish a fraud prevention department. The role of this unit is to observe users making online transactions and block if their actions are suspicious. What’s more, this department guarantees software security when using third-party services. So this structure is needed to minimize the risk of cybercrimes and ensure the stability and reliability of core banking system architecture.

All in all, security measures for building a robust digital banking architecture are complex and diverse. Only a combination of them can bring the desired outcome and ensure software safety. But let’s see how third-party integrations can support digital banking architecture.

Why Are Third-Party Integrations for Core Banking System Architecture Needed?

Today digital banking software seamlessly integrates with third-party services, facilitating the exchange of data with other banks to ensure a convenient user experience and provide clients with more benefits. Plus, it not only ensures a convenient user experience but also increases a client base.

The integration with third-party services makes the financial environment flexible and enables the growth of open banking. For clients, this is a good option that allows them to share financial information via open financial APIs. For example, it’s possible to integrate bank accounts with services that monitor savings plans or track finances.

But you should use only reliable and trustworthy services to ensure clients’ data security. So, third-party integrations should align with your security measures.

How open banking services can drive your business

Let’s see how open banking can assist your company and what benefits you’ll get by integrating third-party services.

First, open banking provides tools for creating new fintech products and services. As a result, companies can speed up the time to market and get more opportunities from digitalization. So, you can be sure that with third-party integrations you’ll deliver innovative solutions to clients’ pains.

Second, with open banking, you’ll better operate in the fintech world and access more commercial opportunities. For example, digital banking companies can swiftly monetize customer data and process payments and transactions.

Third, open banking enhances operational efficiency, allowing customer data sharing among different banks. As a result, there is no need to confirm data each time.

Finally, financial institutions can easily access their customer base and effortlessly reach new clients. Plus, third-party integrations can help acquire new customers.

Advanced Technologies to Add to a Banking Solution

Want to know more about how to enhance a digital banking architecture? Here are some advanced technologies to add to your solution to make it more efficient and secure.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML add much business value to the banking industry. According to Statista, the use of AI in banking can generate around 99 billion U.S. dollars by the year 2030. Artificial intelligence and machine learning can be used to:

- Provide users with personalized offers and recommendations

- Analyze market trends and perform trades

- Facilitate customer authentication

- Improve customer service

- Create chatbots and virtual assistants

- Perform credit scoring and make loan decisions

- Evaluate risks and prevent fraud

In short, AI and ML can make digital banking services more advanced and enhance responding to clients’ needs.

Blockchain

Decentralization of digital banking architecture, using blockchain technology is another perspective for fintech solutions. Decentralized financial institutions and the absence of intermediaries will be a new reality brought by DeFi. Digitalization of physical contracts into smart contracts can make the financial and banking industry better controlled and more secure.

So what does all this mean? First, lending and borrowing processes will be easier because of the absence of intermediaries and the capacity to handle crypto assets. For users, this is a chance to get loans quicker and have more control over their assets.

Robotic Process Automation (RPA)

For the digital banking industry, RPA is a tool for automating repetitive and monotonous tasks, saving time and effort. That’s why this is a good chance for employees to get rid of routine tasks and focus on more strategic duties. For example, bots can analyze clients’ documents necessary for applying for loans. What’s more, they can perform many processes related to audits, customer notifications, card operations, and billing.

How Forbytes Approaches Finance & Banking Software Development

At Forbytes, we offer fintech software development services to assist our clients in entering a market with robust solutions with reliable and secure core banking system architecture. We’re interested in digitizing finances and contributing to developing online banking with numerous integrations.

We serve the needs of banks, funds, credit unions, trading companies, and other financial institutions. As a result, they demonstrate a competitive advantage in their vertical, get many processes automated, and use advanced technologies like AI and ML for better business outcomes.

Be sure that you’ll get an advanced and performant desktop or mobile banking solution with a robust architecture, third-party services, AI integration, and top-notch security measures. At Forbytes, we consider all your requirements and needs to deliver a unique fintech product.

Final Thoughts

In conclusion, to build a robust and reliable digital banking architecture, you’ll need to pick up a relevant architecture design, third-party services, and advanced technologies. What’s more, try to make security a top feature of your fintech solution. That’s why care about security measures that will protect your clients from cyber attacks and fraud. The combination of a few safety approaches will bring the desired outcomes.

Don’t be afraid of integration with extra services as this is a good way to enhance your customer experience and create an open banking solution. Adding AI will be a win-win strategy that will strengthen your competitiveness and differentiate you from others. If you’re still confused and fail to know where to start, our team can guide you on this journey from beginning to end.

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?