In 2022, the biometric systems market worldwide was worth about $42.5 billion. By 2027, this number is expected to almost double, reaching $82.9 billion. Such rapid growth can be explained by biometric solutions becoming an indispensable part of the professional services industry, particularly in finance and banking. People prefer this verification method because of its ease of use, time efficiency, and high protection level.

As of now, biometrics in banking is one of the most reliable security solutions, given that each person bears unique biometric characteristics. In this article, we will look at the essence of biometric authentication from the technical side. Whether you are a business founder planning to integrate this feature into your application or a finance & banking representative striving to learn more about this feature, we have a lot to share with each of you.

Keep reading to learn what biometrics authentication in banking is and how it facilitates user experience.

What Is Biometric Authentication?

Biometric authentication is one of the security measures that leverages people’s biometric characteristics to check the user’s authority and identity. The biometric characteristics can include fingerprints, facial characteristics, voice or retina characteristics, etc. The data on these characteristics is recorded by technology and stored in the database.

To log into an application or perform some operation with the help of biometrics in banking, a person has to use their biometrical data to verify the identity. The system will scan the data with scanners suitable for the given data type. The scanner will check if the presented data corresponds to the data in their database recorded initially by a user. If the match is successful, the user will get permission to proceed with their actions.

Biometrics authentication is a highly secure and innovative method that has a lot of benefits. The biometric data is usually encrypted and stored on the remote server. In contrast to traditional methods like passwords that can be guessed or ID cards that can be lost or stolen, biometric authentication in banking uses people’s unique characteristics as the power to differentiate them and protect their data.

Interested in incorporating financial services into your non-banking business? Discover our new article on embedded banking. There, you will learn how to leverage the money-related processes in your business to retain clients and expand your service line.

Biometric security types

We can differentiate between 3 major categories of biometric security. These include:

- Behavioral. This type of biometric data captures the behavioral patterns of a person. An example of behavioral biometrics is the handwriting pattern.

- Morphological. Morphological biometric is the term denoting physiological peculiarities each person has. For example, a particular voice structure or fingerprints.

- Biological. This category covers biological material like blood, hair, or saliva used to check one’s identity usually applied in criminology. In common life, this method is not used because of the time inefficiency and discomfort for a client.

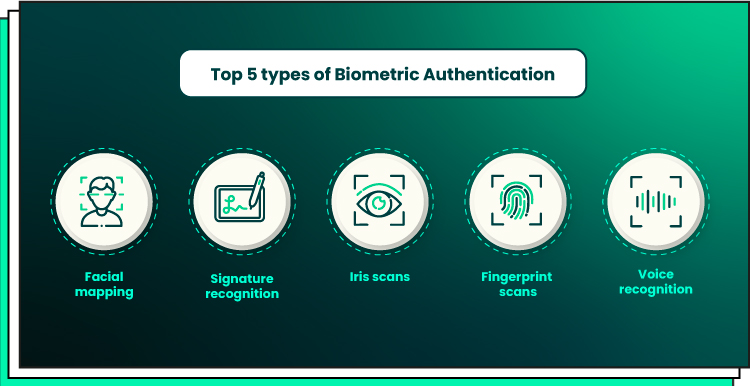

Top 5 Biometric Authentication Methods

There are various mobile biometric authentication methods that people use daily on their devices, from facial and speaker recognition to finger geometry or retina scans. Let’s discuss each type.

Facial mapping

This type is based on the work of convolutional neural networks (CNN). At first, CNN creates a face template based on the scanned data on the user’s face features, including nose, eyes, and mouth. Then, at each attempt, CNN compares the new data to the template and allows a user to proceed with their action in case the match happens. Here is more about this method:

Signature recognition

Signature recognition techniques can be static or dynamic. For static signature recognition, the technology will record the result of your signature and compare your next signature to the initial copy. For dynamic signature recognition, the technology will focus on the process instead of the result. It will record the patterns, timing, pressure, etc. of your writing and compare the next copies to this template.

Iris scans

Under this method of biometric authentication in banking, the technology scans the user’s retina or iris. Retina scans are more precise and take more time to complete compared to iris scans. The drawback of such a method is that the scans should be performed from a very close distance, which may be uncomfortable for users. However, the manufacturers of smart devices are now trying to make this method easier to use.

Fingerprint scans

Each person has a unique fingerprint ridge, also used in biometric security techniques. For fingerprint scans, the system first records the data on the user’s fingerprint ridge as a template. Then, all a user has to do is place their finger at a scan and hold it for a second or few. It’s important to use the same finger the data on which has been stored in the template.

Voice recognition

The voice recognition technique is based on collecting data on one’s speech and voice, including pitch, accent, and speed. Voice recognition is implemented for security purposes, voice search, and even assigning commands to smart devices.

So, these were the top 5 methods of using biometrics in banking. There exist some other, less common types, including vein recognition, gait recognition, and finger geometry. For vein recognition, a hand vein scanner is applied. In the case of gait recognition, the technology studies a person’s speed, style, and angles when running or walking and uses this data to create a template. Finally, for finger geometry, biometric scanning technology scans the form, structure, lengths, etc. of fingers, usually in three-dimensional imagery for better accuracy.

Biometric Authentication in Banking: Application and Benefits

One of the most common applications of this technology is the use of biometric authentication in the finance and banking sectors. For financial entities, biometric authentication is the means of ensuring security and convenience for their clients. With the rise of mobile banking, this security method has become even more widely used.

Typically, mobile banking apps leverage biometric authentication scanning with the help of mobile phone cameras or sensors. Among the most popular types of biometric authentication in banking, we can mention facial mapping, fingerprint identification, and voice recognition. They are used for the following purposes:

- Verifying and using bank accounts. To confirm their identity, clients can use biometric authentication, which eases the process of logging into the bank account, opening a banking app, confirming changes in the app, etc.

- Confirming financial operations. A biometric authentication app can be used to confirm financial operations like money transfers or online payments. Instead of typing in the identity data manually, a user can choose the biometric authentication method to complete the action in a few seconds.

Biometric authentication in banking brings numerous benefits. Before we look at the major advantages it offers, let us share a few words about Forbytes’ expertise in finance & banking software development.

For more than 12 years, we’ve been helping our clients in Europe and the US turn their business expectations into achievable and tech-driven results. We offer a wide service line and help businesses pick the best service type and tech team depending on their goals, budget, and limitations. Contact us if you’d like us to tell you more about our services and software development capabilities.

Top-notch operation security

When it comes to money operations and transactions, security is a top priority that can be well ensured with biometric authentication practices. All clients’ sensitive data and confidential data of a business are well protected. It’s extremely hard to fake the unique biometric characteristics of each person, which is why leveraging biometrics for banks is a good way to eliminate the risks of identity fraud.

Availability

This benefit is tightly connected to the previous one. As biometric authentication relies on the unique physical traits of each person, using this authentication method is always available for a client. Anytime, they can scan their face or fingers and get access to the banking services they need. This, in turn, saves a lot of time and makes the user experience more pleasant.

Efficiency

The technology used for biometrics in banking is relatively affordable and easy to set up and maintain. Our technology experts can share the most efficient strategy for implementing biometric authentication into your solution, be it a banking app or some other piece of software. Leave us a note, and we will get back to you in the nearest time.

Innovation

The more advanced the technology becomes, the more responsibility lies on banking service providers. To stay competitive and make sure that clients trust them, financial entities should keep pace with the latest advancements and technological innovations. The use of biometric authentication is a growing trend in tech. By supporting it, banking service providers will demonstrate their readiness to upgrade their solutions and stay tuned for effective security updates.

Ease of use

Biometric authentication is simple and easy to use. When it comes to traditional security measures like using passwords, people often forget them and lose access to their financial accounts. With biometrics data, such cases cannot happen, as the identity proofs are literally “always with a client.”

5 Components of Biometrics in Banking

To implement biometric authentication in banking, you will have to incorporate the key 5 components. Mind these components at the project planning stage because each of them will require effort and attention from your software engineering team.

Multifactor authentication

Mobile biometric authentication is a preferable method for confirming a person’s identity. However, it shouldn’t be the single method implemented by a company. Some problems with scanning may occur, and a user will need to use alternative methods. Thus, you should implement multifactor authentication in which different methods are available, including password checks, the confirmation of the user’s data, etc.

Integration of APIs

If you partner with other companies, you will also have to build a financial API allowing them to easily use the mobile biometric authentication method leveraged by you. It will simplify the implementation of your services and ease cooperation with other companies.

If you wonder how banking companies can partner with non-financial entities and provide them with banking services, check out our recent article about Banking as a Service (BaaS).

Mobile security

As the number of mobile users increases, more and more services are shifted to mobile and require profound protection. This is why you should also care about the mobile security of your banking solutions. For this, implement advanced mobile security measures like debugging protection, root detection, anti-hooking, and others.

Transaction data signing

Transaction data signing is a part of the authentication process that generates the encrypted code to confirm user action. Such a method is obligatory for sensitive operations. For example, for transfers where big sums of money are involved or when the user requests a change in personal data.

Regulatory compliance

The implementation of biometrics in banking should comply with the rules and regulations imposed by the organizations governing the finance & banking sector. Among the most important regulations to follow, we can mention FFIEC (Federal Financial Institutions Examination Council), PSD2 (Payment Services Directive 2), and NIST (National Institute of Standards and Technology).

Request an IT consultation with our finance & banking development experts to discuss your goals and challenges and get an effective compliance plan.

Ready to Turn Your Application Super Secure?

Integrating biometric authentication into your banking app is a win-win decision. For your clients, it will mean quick and easy access to banking services. For your business, it will mean supreme security of authentication procedures, close to zero risk of data breach, and a high customer satisfaction rate.

We are a software development partner working in the areas of finance & banking, ecommerce, real estate, logistics, and others. Having more than 12 years of experience behind us, we can help you develop the plan to integrate the function of mobile biometric authentication into your app and implement it with the highest efficiency.

Contact us for a free consultation. During this meeting, we will demonstrate our expertise and capabilities, helping you decide if we can be the perfect match for your project.

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?