Fintech firms have undeniably spurred a profound transformation in mobile banking, ushering in numerous fintech opportunities including digital cross-selling in banks. The traditional era of banks primarily relying on physical branches for customer interactions has significantly diminished. Instead, mobile banking has ascended as a dominant fintech application development trend, further accelerated by the COVID-19 pandemic, which prompted individuals to stay home for safety.

For example, in 2022, 78% of U.S. adults favor mobile apps or websites for banking, while only 29% opt for in-person banking. In response, established financial institutions have recognized the imperative of swiftly integrating innovative bank cross-selling features to maintain their competitive edge.

Introduction to Cross-Selling in Banking

But what is cross-selling in banking? Cross-selling, within the context of mobile banking, is the practice of promoting and offering additional financial products and services to existing users of mobile banking applications. It represents a shift from merely providing transactional services to building comprehensive financial relationships with customers. The goal is to identify unmet financial needs, offer tailored bank cross-selling solutions, and enhance the customer’s overall experience.

These are just a few examples of banking products that can be cross-sold through mobile banking, catering to a wide range of customer needs and aspirations:

- Savings accounts. Encourage customers to open savings accounts, promoting financial security and growth through interest on deposits.

- Investment products. Offer various investment options like mutual funds, stocks, and bonds, attracting those aiming to build wealth and achieve long-term financial goals.

- Insurance offerings. Promote insurance products, such as life insurance, health insurance, and property insurance, addressing customers’ protection and security needs.

- Credit cards. Cross-sell credit cards for convenient purchases and financial management, while generating revenue through interest and fees.

- Personal loans. Assist customers with financial needs like home renovations, education expenses, or debt consolidation through personal loans within the mobile banking app.

- Mortgage services. Guide customers in the process of home buying with cross-sold mortgage services, simplifying the complexities of home financing.

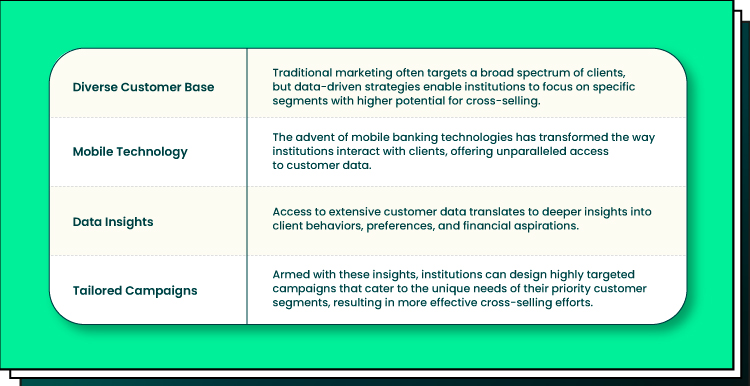

These are the four pillars of efficient digitized cross-selling in banks:

This article aims to shed light on the revolutionary changes taking place in the world of banking, driven by custom mobile development technology and innovative financial technology solutions. We’ll explore the significance of mobile cross-selling in banking, fintech’s role, and the numerous opportunities it presents for both financial institutions and consumers.

Understanding customer needs: personalized bank cross-selling strategies

Conventional financial institutions, including traditional banks and credit unions, have often leaned on broad, one-size-fits-all marketing approaches to engage their client base and cross-sell banking products. However, a more efficient strategy involves embracing a data-driven approach with a specific focus, made feasible by the advent of mobile banking technologies. Before cross-selling banking products via mobile banking apps, understand each customer’s unique needs and financial goals through mobile data analytics.

This streamlined plan ensures a customer-centric approach to cross-selling:

- Data analysis. Begin by analyzing the customer’s transaction history and behavior.

- Identify needs. Look for patterns and needs. For instance, if they check balances frequently, they may be interested in savings, investments, or insurance.

- Select products. Choose relevant products and services for cross-selling.

- Personalize approach. Tailor your approach to the customer’s specific needs.

- Engage. Engage the customer through appropriate channels.

- Provide information. Offer clear product information.

- Encourage action. Prompt the customer to take action based on their needs.

- Support. Provide ongoing support and assistance.

- Feedback loop. Gather feedback and adapt your approach for future interactions.

Cross-selling baking product knowledge and training: empowering staff with customer insight

In today’s banking landscape, aggressive bank cross-selling tactics from the past have proven ineffective. The focus now lies in fostering delicacy, providing comprehensive training, and empowering staff members with the right knowledge. When employees have swift access to consumer data, it enables them to make pertinent recommendations for cross-selling banking products. The key points for empowering staff:

- Comprehensive product knowledge. Front-line staff, whether working in branches or handling phone inquiries, should possess in-depth knowledge about the bank’s product offerings.

- The customer needs alignment. Equipped with the right information, personnel can skillfully match bank products to individual customer needs, ensuring a more personalized and valuable banking experience.

- Building trust. When staff members are armed with reliable information, they can establish trust with clients, which is a fundamental step in building customer confidence in the bank.

- Effortless cross-selling. With customer trust as the foundation, the cross-selling process becomes more effortless and seamless. This, in turn, contributes to the growth of customer trust in the bank’s services.

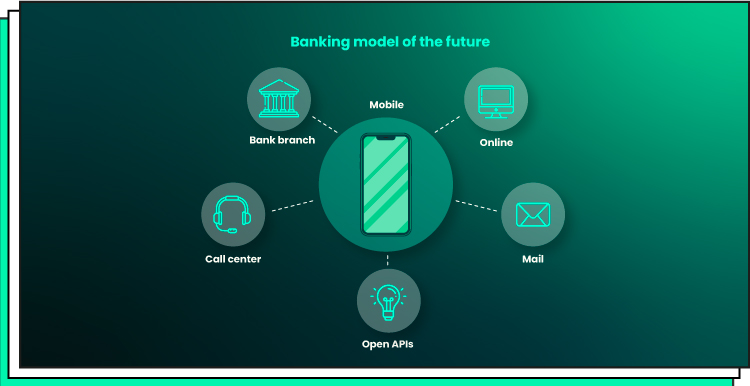

Cross-selling channels: in-branch, online, and mobile

Cross-selling in banks can occur through various channels, each with its unique advantages. In-branch cross-selling allows for face-to-face interactions, which can build trust and credibility. However, online and mobile channels provide convenience, allowing customers to explore product offerings at their own pace.

In-branch cross-selling

This channel facilitates face-to-face interactions, allowing bank staff to engage with customers personally. These interactions can be pivotal in establishing trust, credibility, and long-term customer relationships. Customers often appreciate the human touch and the ability to ask questions, seek clarification, and receive recommendations from knowledgeable staff members. In this channel, customers can directly assess the sincerity and expertise of the bank staff, and this can be particularly important in complex financial decisions.

Online cross-selling

Online cross-selling leverages the power of the internet to reach a broader audience. It provides customers with the convenience of exploring and comparing different products and services from the comfort of their own homes or workplaces. The online channel is accessible 24/7, which means that customers can browse and consider cross-sell opportunities at their own pace. It’s especially valuable for customers who prefer a self-service approach and those who may not have the time to visit a physical branch during working hours.

Mobile cross-selling

The mobile channel is an integral part of the online banking ecosystem, but it deserves special attention. With the proliferation of smartphones, mobile apps have become a cornerstone of the digital banking experience including the immense potential for product cross-selling:

- Mobile apps, integral to the online ecosystem, are now central to the digital banking experience, driven by the prevalence of smartphones.

- They provide unparalleled customer flexibility and accessibility. Users can access accounts, explore product details, and evaluate cross-selling opportunities at their convenience.

- Mobile apps offer a platform for precise, personalized marketing, biometric mobile security measures, and other features utilizing advanced data analysis and user preferences for tailored cross-selling suggestions within the app interface. Mobile banking is a pivotal arena for effective product cross-selling.

Effective Techniques: Mobile Cross-Selling in Banking

The customer experience management and personalization method is the key to effective cross-selling. Customers appreciate when banks demonstrate a genuine understanding of their needs, and this builds trust and loyalty. Cross-selling banking is more than just suggesting products; it’s about personalization and offering solutions that align with the customer’s financial journey. Some effective techniques include:

- Needs assessment. Engage in meaningful dialogs and surveys with customers to understand their financial goals and aspirations. This allows for highly targeted product recommendations suggested through an efficiently designed mobile app interface.

- Bundling. Offer product bundles that provide value for customers. For example, bundling a savings account with a credit card and investment options can be an attractive package for many (this can be provided via integrated ads).

- Timing. Identify the right moments to present cross-selling opportunities. For instance, when a customer’s account balance reaches a certain threshold, it might be the right time to offer information about investment options via pop-ups or tip panels.

- Follow-up. After a customer has purchased a cross-sell product, ensure continuous support and follow-up. This not only ensures satisfaction but also paves the way for further cross-selling opportunities.

- Feedback loop. Encourage feedback from customers to refine cross-selling strategies. Continuous improvement is essential in delivering a superior customer experience.

Ethical Considerations and Compliance

While cross-selling is a powerful strategy, it must be conducted with the utmost ethics and compliance. The well-being of customers should always be a top priority. Ethical considerations in cross-selling include:

- Transparency. Customers should be provided with clear and accurate information about products, including fees, terms, and conditions.

- Informed consent. Ensure that customers understand the products they are being offered and that they willingly consent to the cross-sell.

- Conflict of interest. Prevent situations where employees may push products that are not in the customer’s best interest due to incentives or quotas.

- Privacy and data security. Protect customer data and privacy, ensuring that sensitive information is handled securely.

- Regulatory compliance. Comply with all relevant financial regulations and ensure that the cross-selling practices adhere to the law.

Bank of America’s Cross-Selling Success Case

Successful cross-selling example in banking: Bank of America has achieved significant success in cross-selling by seamlessly integrating its product offerings into the customer experience, resulting in increased revenue and higher customer satisfaction. According to a 2018 Deloitte report, the bank boosted its cross-selling revenue by 15% in 2017, primarily due to its emphasis on customer segmentation and targeted marketing campaigns.

The bank has also harnessed technology-driven front-end platforms, enhancing efficiency in offering fee-based services to customers. These platforms allow sales personnel to access and utilize customer data via digital interfaces during client meetings, reducing the reliance on senior bankers’ relationships and cutting operational costs. Bank of America set up a cross-sell opportunity by extending its digital engagement strategy across product lines. This approach serves as a model for effectively promoting its range of financial solutions.

The Benefits of Cross-Selling in Banks

Revenue growth

Cross-selling allows banks to tap into existing customer bases and generate more income from each customer.

Customer retention

By providing a one-stop solution for customers’ financial needs, banks can enhance customer satisfaction and loyalty. Satisfied customers are more likely to stay with their bank and recommend it to others.

Cost efficiency

Cross-selling to existing customers is often more cost-effective than acquiring new ones. The marketing and acquisition costs are typically lower.

Competitive edge

Banks that excel in cross-selling gain a competitive edge in the industry. They can provide a more comprehensive range of services, attracting new customers as well.

Data insights

Cross-selling can provide valuable data insights that help banks understand their customers better, refining their product offerings and marketing strategies.

Measuring Effectiveness of Bank Cross-Selling with KPIs

Measuring the effectiveness of cross-selling efforts is essential to refine strategies and track progress. Key Performance Indicators (KPIs) can provide valuable insights. Some relevant KPIs for cross-selling in banking include:

- Cross-sell ratio. The number of cross-sell products per customer or per account.

- Revenue per customer. The additional revenue generated from cross-sell products.

- Customer satisfaction. Customer surveys and feedback to gauge satisfaction levels.

- Customer retention rate. The percentage of customers who remain with the bank.

- Compliance score. Ensuring adherence to ethical and regulatory standards.

Role of CRM systems in cross-selling banking

Customer Relationship Management (CRM) systems play a pivotal role in facilitating cross-selling efforts within the banking industry. CRM systems serve as invaluable tools for banks, aiding in the management and analysis of customer data, ultimately leading to more personalized and effective cross-selling. Here’s how CRM systems contribute:

- Centralized customer information. CRM systems are adept at storing and centralizing vast amounts of customer information. This data repository enables banks to gain a comprehensive understanding of their customers’ needs, preferences, and behaviors, which is vital for targeted cross-selling efforts.

- Automated communication and follow-up. These systems also automate communication and follow-up processes, ensuring that the right information reaches the right customer at the right time. Automated reminders and notifications can prompt staff to follow up on cross-selling opportunities, enhancing the overall efficiency of the process.

- Identifying cross-selling opportunities. CRM systems provide sophisticated analytics that help banks identify cross-selling opportunities. By analyzing customer data, these systems can pinpoint areas where additional products or services may be of interest to individual customers, further enabling tailored cross-selling strategies.

Partnering with a reputable technology solution provider like Forbytes can greatly assist banks in developing and implementing an effective CRM system for their banking services. The expertise of Forbytes in CRM development can help banks streamline their cross-selling strategies, thereby enhancing the overall quality of customer relationships and the success of cross-selling efforts.

Emerging Trends in Banking Cross-Selling Methods

The landscape of cross-selling in banking is continually evolving. Some emerging trends include:

- Artificial Intelligence software development and Machine Learning. Leveraging AI and machine learning for enhanced customer data analysis, leading to more accurate predictions of cross-selling opportunities.

- The emergence of digital banking. The ascent of digital banking and the banking-as-a-service paradigm has opened new avenues for cross-selling, where online and mobile platforms play an increasingly vital role.

- Ecosystem banking. In a bid to expand cross-selling initiatives, some banks are forging strategic partnerships with external entities, broadening their product and service offerings within their platform.

- Precision in personalization. Advanced personalization techniques empower banks to fine-tune cross-sell recommendations, further enhancing customer engagement.

- Navigating regulatory transformations. Adapting cross-selling practices to align with evolving regulatory landscapes is imperative for banks to maintain compliance and operational integrity.

The Final Word

The art of cross-selling in banking is a powerful and intricate strategy that has the potential to significantly boost revenue, strengthen customer relationships, and drive substantial business growth. Implementing effective measurement tools and CRM systems, while keeping a keen eye on emerging industry trends, will undoubtedly cement the role of cross-selling in shaping the future of banking.

If you’re looking to capitalize on these opportunities and need assistance in setting up cutting-edge IT solutions and mobile applications for fintech and cross-selling in banking, don’t hesitate to reach out to Forbytes.

Contact us today to explore the possibilities and propel your financial institution to new heights!

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?