Each day, people generate unbelievable volumes of data. 720,000 hours of video content on YouTube, 4 million GB of Facebook data, and almost 300 billion emails. And these figures are growing daily. In such a situation, you know how important it is to catch the new opportunities and be among people who react quickly. Be among the first to discover hidden benefits.

If you plan to invest in financial technology, this article may help you decide what solutions are worth your attention. Today, we will discuss one of the emerging trends in software product engineering — Banking as a Service. You will find out what BaaS is, what benefits it offers, and whether it has a long-term value for the financial industry as a whole.

What Is Banking as a Service?

Before diving into all benefits and opportunities offered by such a solution, let us answer the question “What is BaaS?” Banking as a Service, or BaaS, is providing banking services through a third party. Banking as a Service enables businesses that are not involved in the financial industry to manage and use regulated financial infrastructures.

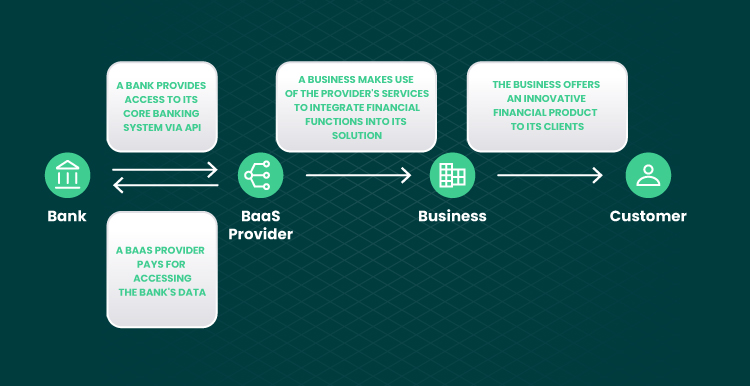

I assume that you may be confused with this interaction chain. Firstly, a bank opens its capabilities to a business. Then, the business provides services to a client. Why do we need all this if a client can directly access financial institutions and get rid of mediators?

The answer is pretty simple. Under the BaaS concept, businesses provide faster and more convenient opportunities and services to the end user. They create hybrid and highly flexible banking propositions, including those of mobile banking. They reshape the traditional view of banking and the value it brings.

How It All Started

The birth of the BaaS concept was determined by the emergence of private-labeled credit cards. These are the cards issued under the cooperation between a bank and a large distributor or merchant. Private-labeled cards are intended for use only at distributor-owned locations. By inventing such cards, retailers could offer more advantageous terms for their audience. For a client, this solution combined the convenience of a credit card with the attractiveness of relationships with a brand. For a retailer, private-labeled cards were the tool for raising sales and encouraging a client to stay loyal.

E-banking started to grow and earn more and more users. Distributors realized that they can get much more benefits by expanding the range of financial offerings. They started integrating more complex banking products and services into their solutions. Businesses looked for ways to provide more sophisticated banking services for their customers. This formed the ground for the development and growth of BaaS. Now, the more BaaS is growing, the more money management needs of customers are satisfied.

5 Factors that Made BaaS Possible

- Rising needs of customers. Put yourself into client’s shoes. They now favor the all-in-one approach to software product engineering. That is, your customers do not want to switch apps to satisfy their needs. They want to have embedded finance management in one complex solution. This can ensure a sophisticated and effortless experience for them.

- Widespread use of APIs. API, or Application Programming Interface, allows two applications to interact with each other and access each other’s data. It’s like a bridge connecting two solutions and enabling their communication. Thanks to APIs, third-party distributors access the bank-owned financial infrastructures and provide services based on this.

- The growth of cloud technology. Cloud-based solutions have added security to the finance industry. This was a real need in the background of freedom and flexibility offered to clients. Easy scalability and automation, which also come with the cloud, enabled third-party distributors to embed complex propositions into their solutions.

- Fintech industry evolution. The fintech industry is rapidly growing, with solutions becoming more and more sophisticated. To expand their services, fintech businesses need to integrate their products with banking capabilities. Instead of looking for ways to get a banking license and invest a lot of money to comply with regulations, they choose to hire a BaaS provider.

- The regulatory base of banking. There are compliance and regulatory requirements for getting and maintaining banking licenses. This prevents the scenario where fintech companies become banks themselves and increases the need for BaaS solutions.

Thanks to the combination of these factors, the BaaS system of bank-business-client interaction has grown. The whole process of using Banking as a Service looks as follows:

BaaS vs Open Banking vs Platform Banking

You need to differentiate these three terms. BaaS is frequently confused with open banking as the latter also uses API to connect banks with non-banks. Yet, the core functions of open banking differ significantly. Under this model, non-banks use API to access banks’ data and implement it in their financial services. For instance, there is a finance management application that people use for keeping track of their monthly spending. The app uses API to integrate transactional data from a bank account of a user and runs analytical operations to help them manage finances more efficiently and improve spending habits. The app itself does not provide any new banking service. It merely integrates the data that is already stored by a bank into the account management functionality. This is how business models of open banking work.

Unlike open banking, Banking as a Service presents a user with a whole new kind of service. The idea behind BaaS is not to give clients what is already built but to use it as a ground for building new banking experiences.

Also, there is a difference between Banking as a Service and platform banking. The main players of banking platforms are not third parties but banks themselves. They use the power of financial technology to provide access to the services offered by a bank. For example, a bank may build an AI-based tool aimed to help users choose the best investment opportunity and quickly run their everyday banking routine. Nowadays, financial institutions use platform banking to retain clients and to allow them to fully immerse themselves in the fintech industry.

Under the BaaS concept, the end user interacts not with a bank itself but with a third party that offers new services. The brand’s frontend is connected to the BaaS provider using API, which, in turn, connects the provider with a bank. This chain enables distributors, brands, and fintech companies to integrate banking services directly into their products, be it ecommerce websites, fintech apps, or financial services.

BaaS Advantages

Let’s review Banking as a Service benefits for three categories of players: customers, banks, and businesses.

Benefits for a Client

Banking as a Service brings innovation and customization to finance product development. Clients get the following advantages:

- Greater services offered. If there were no BaaS providers, clients would make use of bank services directly. So, it is not that a customer needs BaaS — BaaS needs a customer. This is why BaaS providers aim to offer a truly superior experience. They put effort to meet the demands of banking clients who are digital natives and real tech-savvy.

- More products to choose from. The wider the choice, the better for a client. High competition is no good news for the service providers. But for customers, this creates more opportunities for flexibility. Innovative solutions strive to be client-oriented and offer all necessary functions in one place. This increases financial transparency and simplifies money management compared to operations done in traditional bank accounts.

Benefits for a Bank

Like clients, banks offering API-based data access also engage in a win-to-win strategy. At a minimum, they do not lose anything and earn more money. At a maximum, they get personal value out of sharing their data with BaaS providers.

- Bank services are used by more people. Banking as a Service does not impose any extra workload on a bank. Instead, BaaS gives it new revenue lines and streams. That is, a bank provides data access via API and charges a fee for that. It does not care how third-party distributors will attract the audience, where they will look for funds, whether they will outstand the competition, etc. They do not need to invest money in development. Their main responsibility is only to make sure that client data is well protected against breaches.

- Banks get to know their audience’s needs. By analyzing how third-party BaaS provider performs, banks can generate insights into their customer demand. What functionality they use, what helps them to ease finance management, what irritates them, etc. Such insights may be generated from machine learning solutions for finance and incorporated into the bank’s own product development.

Benefits for a Business

Non-bank entities, businesses, and fintech companies that provide BaaS have the most responsible role in this game. Apart from benefits, they may also face challenges to investing in a new solution, as it could be with any other type of product development. Not to fail their idea, they need to build a workable risk management strategy. But despite risks, they can still gain a lot of strengths.

- Businesses become bankers without being bankers. According to FinancesOnline, payments and settlements is the most popular startup segment among US bank investors. With the rise of the fintech industry, they all see great potential in investing in banking solutions. In order to offer banking services themselves and bypass banking regulations, businesses choose to act as a third party and make money by being a mediator between a financial institution and a client.

- Client recognition. Yes, it is not easy for a customer to entrust their financial data to a third-party business they have never heard about. By connecting with established bank institutions, BaaS providers make use of the bank’s reputation in the eyes of a customer and quickly earn their trust.

BaaS Challenges

Here are some of the challenges of BaaS providers that impede the widespread implementation of this strategy.

- Choice of BaaS provider. Businesses sometimes struggle with choosing the right provider of BaaS services. As a factor determining their preference, we may mention easy integration and management. Also, businesses look at the capacity of a provider to expose business processes optimally, deliver value, and present end users with maximum capabilities.

- Responsibility shift. Before the growth of fintech, security of operations and client trust were the strong sides of a traditional financial institution. It helped such institutions win the competition. Now, customers entrust their payment info to their devices easily (pretty the same as they do it in banks). Traditional banks are gradually losing this advantage, which makes them look for ways to improve. Their banking services are becoming more sophisticated and convenient. This makes it harder for BaaS providers and fintech companies to attract and retain the audience.

- Outdated bank structure. The functions that Banking as Service providers present to their clients heavily depend on the capacities of traditional banks. Sometimes, their core systems are outdated and unable to run third-party integrations. So, to offer more forward-looking financial products, the architecture of banks themselves has to be modernized.

Banking as a Service by Example

Definitions and theory are all good, but the practice is better. Let’s try to understand how BaaS works in real life. Or how it could work, if you were a BaaS adopter. Imagine that you are the owner of a popular ecommerce website selling pretty everything, from clothing and books to toys and hardware. As your audience grows daily, you want to find new ways to reach them. How can you prevent your customers from going to competitors? How can you evolve from goods provider to an integral part of consumer routine? These are the thoughts that daily occupy your mind.

At this point, we see that your goal is to expand your services (have more money) and retain your audience (have more influence on their behavior). It would be great if you enabled your clients not only to buy from you but also to pay with a card offered by you. Having such a card and, more importantly, money on this card, your buyers would not go to a competitor. The idea seems viable, doesn’t it? Great, now let’s move to the part when you implemented it in reality.

You select a BaaS provider (the one who uses API to connect with a bank) and purchase its services. Now, you are granted access to the financial infrastructure owned by the bank. You, in turn, provide bank functionality to your end users. For instance, you issue debit cards for your return customers. Finances that are stored on these cards and all operations are managed by the bank that provides banking infrastructure. Each time your clients pay with their debit card, they get loyalty points that can be used for the purchase at your e-store.

Via these debit cards, you unlock access to the consumer habits of your audience and get more control over their choices. Soon, you decide to go even further: you offer the opportunity to buy goods from you on credit. A perfect chance for people who want to purchase an expensive smartphone or, say, a laptop but are currently on a shoestring budget. Everything described above represents the concept of Banking as a Service, where you, as a non-bank entity provide bank-powered financial services to your customers.

In real life, there also are many companies that integrate BaaS solutions into their business.

Uber

In collaboration with Green Dot bank, Uber issues debit cards for drivers and partners. When the company hires a new driver, the latter has the opportunity to get a card to cash out their daily earnings from the completed rides. Also, drivers can use these cards to purchase goods from merchant partners and get cashback bonuses.

Cash App

Initially, Cash App developed by Square was designed to manage peer-to-peer payment operations. Soon, the product grew from a limited-function app to a solution comprising numerous product lines in one place. Users now can use Cash App to trade cryptocurrency, manage investments, or activate ACH payment processing. The app partners with Marqeta and Sutton Bank. Users can get a debit card to purchase goods in stores and withdraw money from ATMs.

SoFi

SoFi is a financial service provider. It offers the opportunity to set up finance management accounts and run all operations in one place. Users get a customized debit card for their cash management and can access savings tools via their accounts. The company partners with Bancorp. Thanks to Bancorp, SoFi can pre-integrate banking management functions into its solution.

Summarizing All the Mentioned

In this article, we answered the question, “What is Banking as a Service?” Now, you know why it’s a promising and growing concept in the fintech industry and how it differs from other notions. As you see, there are benefits and risks of investing in BaaS, like in any other case of product development. But BaaS is an unoccupied niche yet, which gives you more chances to outstand the competition. If the banking industry in your country is well-developed, you can build a BaaS solution and expand your influence on the market.

If you’ve considered all opportunities and risks and want to build a fintech product — contact the Forbytes team. Our experts will gladly help you with anything from strategy planning to software development and testing.

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?