Today, companies strive to ensure maximum convenience for their customers because convenience is what makes a client turn to that business again and again. Convenience can be achieved in diverse ways: free delivery options, the creation of mobile banking apps, 24/7 customer support, and more. Embedded finance is also a chance for businesses to make customer experience convenient and easy and differentiate from competitors.

This notion enables the client to conduct financial operations without leaving the company’s site or app. By implementing embedded payments, you increase brand loyalty and gain a competitive advantage. We see the great potential of embedded financing to disrupt the industry and streamline user experience.

Read this article to discover what embedded banking is, what benefits and challenges are associated with this notion, and how it can transform your business.

What Is Embedded Finance?

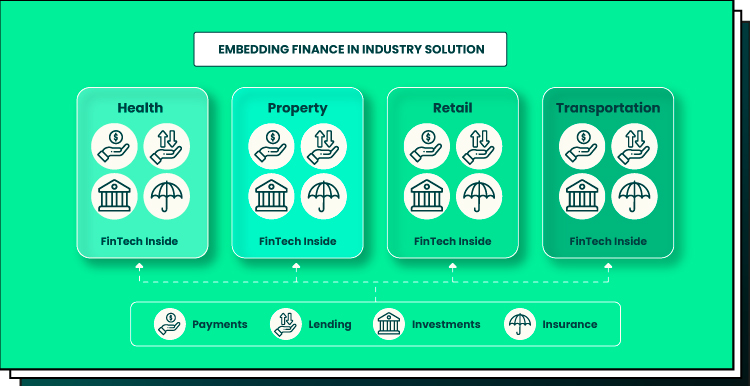

Let’s start by discussing the embedded finance definition. Embedded finance is a term that has existed for a long time in the fintech market but gained much popularity in recent years. Embedded payments refer to the payments a client can make for products or services without leaving the application. In other words, it marks the situation when a non-financial company offers financial services in addition to its core business services or products to ease the client’s journey.

Embedded financing has been adopted by many organizations and companies striving to launch their financial services. The concept is implemented in many ways, from integrating a debit or credit card into an e-commerce platform to providing insurance services or loan instruments.

By adopting an embedded banking strategy, businesses give their customers more convenience and increase user satisfaction. A client shouldn’t go to any external service to make a payment; everything can be done within the organization or company providing services.

You may wonder why such a convenient option has raised much interest in the finance ecosystem only in recent years. That is because of the growing competition. Before, there was no need for companies to invest in embedded fintech as they could easily establish themselves in the finance market.

Today, the situation is different. By 2026, the fintech market is expected to grow to more than $37 billion. More and more promising businesses are entering this industry. To compete with key players, they need to provide their clients with some kind of advantage. Embedded finance plays into their hands as it saves clients time, improves user convenience, and generally transforms the commercial service industry.

Embedded banking as a part of the embedded finance concept

Many people use the terms embedded banking and embedded finance interchangeably. However, there is a difference between these two. Embedded finance is the general term covering operations and finance services provided by non-finance companies. It’s like an umbrella term for different kinds of services, including embedded banking services.

In its turn, embedded banking focuses on banking only and covers the banking services provided by a non-financial company. It has a lot to do with Banking as a Service, which is a concept denoting software that allows regulated institutions to deliver financial services to non-financial companies.

Although both embedded banking and banking as a service streamline the use of financial services, these two notions differ in their essence. Embedded banking involves ensuring front-end access to financial services. BaaS, in its turn, involves creating and using a backend banking infrastructure.

5 Essential Components of Embedded Finance

You may wonder what components are obligatory to consider if you want to integrate embedded banking into your finance solutions. Let’s talk about this below:

- Non-financial platform. The first requirement is that you run a non-financial platform or application. In other words, the primary interface of your business is centered on delivering services and products.

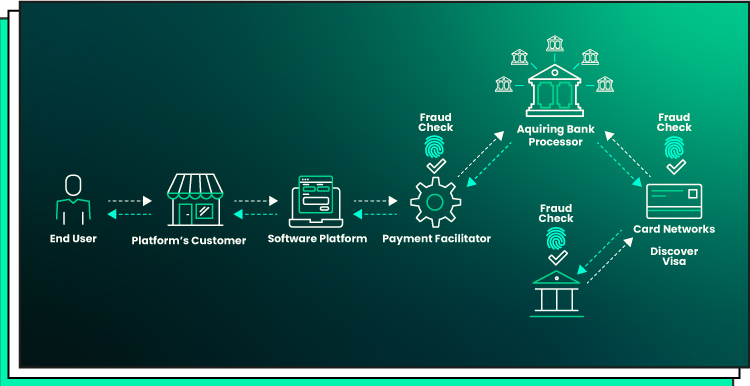

- API integration. Your platform should be capable of API integration. Financial APIs are implemented in the data exchange processes, transaction management, financial service delivery, etc. You will need an API to connect your platform to the core of financial management, be it a financial company platform or some other banking technologies.

- UI and UX. You will need to adjust your UI/UX to the standards and requirements of financial management interfaces. To encourage clients to use your financial services, you should provide them with a convenient UI/UX design enabling them to make payments intuitively, request loans, track insurance, and more.

- Data security and integrity. Customer data integrity and security should be ensured on the level of both financial and non-financial companies. User data should be securely stored and managed in compliance with regulations such as KYC (know-your-customer) or AML (anti-money-laundering). For this, you should develop effective data management policies and outline them on your website.

- Monetization strategy. Embedded financing will require you to make investments. Thus, you will expect your investments to bring you profit. There are many monetization strategies to choose from when it comes to embedded fintech. For example, the finance strategy can include charging transaction fees or commissions for services or purchases, offering paid services, etc.

Forbytes is one of the software companies that can help you plan the whole process of embedded payment integration and implement it from start to finish. We will also make sure that all the components of embedded financial services are considered in your project and that the customer expectations are successfully brought to life.

Embedded Finance Benefits

After we’ve explored the essence of embedded banking, it’s vital to discover the benefits it can bring to business owners. The main benefits of embedded payments include:

Increased customer trust

Embedded financing increases customer trust and loyalty, giving users direct and instant access to their money. Without leaving the platform, users can make purchases, manage their money, track transactions, etc., without the need to use external banking services. What’s more, clients using embedded banking are often provided with unique exclusive offers and rewards, which has a positive impact on user experience.

By owning and using a debit card released by your company, a user establishes a closer relationship with your brand. The more convenient experience you ensure, the more chances there are that the client will stay within your ecosystem for an extended time.

New revenue opportunities

Embedded fintech is the chance for businesses to get new revenue streams. While increasing the customer base, businesses also extend their service line and expand partnership capabilities. If you have not offered financial services before, embedded banking can also help you forge new relationships with other companies and partners. Together, you can invest in different user engagement methods (for example, cash-back offers) to attract more clients and exchange the audience.

Less regulatory mess

Another benefit you can get with embedded financing is the reduction of the regulatory burden that lies on you or your clients. While offering financial services directly, companies must comply with laws, rules, and regulations. If you choose embedded finances instead of external financial services, you get rid of the regulatory mess. As your financial services are embedded, you do not offer direct financial services and are not obligated to follow the regulations or requirements. The latter are followed by the underlying financial institution you partner with.

Time and resource efficiency

The fewer steps a client needs to take to reach their goals on your platform, the better. By implementing the embedded financial services, you make the client journey more efficient and straight. Instead of switching from an app to an app, a user stays within your ecosystem and saves their time and effort. By building a reach ecosystem with financial visibility, a business increases client retention and fosters trust.

Embedded Finance Examples: 3 Real-Life Cases

There are various use cases of embedded finance in the area of e-commerce and professional services. Below, you will see a few popular embedded financing examples.

Shopify Balance

Shopify Balance is an embedded banking service owned by Shopify. It’s a business bank service linked directly to the Shopify Store. With its help, store owners can manage their finances and keep records of their financial operations without the need to refer to external banking services. Shopify Balance saves time for both merchants and customers, allowing them to skip traditional banking operations and ensuring quick access to their funds.

If a merchant wishes, they can also get a branded debit card and use it to withdraw money at an ATM or purchase goods.

Amazon’s EMI

EMI (Easy Monthly Installments) by Amazon is an example of how embedded payments can increase the number of purchases. By referring to EMI administration, Amazon’s end users can get and reimburse credits when purchasing an item. For instance, a buyer wishes to purchase a smartphone on Amazon and break the payment down into parts. For this, they will request EMI installments and make regularly scheduled payments.

Lyft Direct

One more example of embedded banking in real life is Lyft Direct. It’s an embedded fintech service offered exclusively to Lyft drivers. By using it, they get access to the checking account and the linked debit cards or credit cards. With Lyft Direct, drivers instantly receive payments into their accounts instead of waiting for two weeks or more for the bank to complete the transactions to their bank accounts. Also, drivers can use the card to make use of cash-back offers and get exclusive rewards.

Embedded Finance Challenges

There are several challenges associated with the embedded finance market. One of them is the ambiguity that can occur when the roles and responsibilities in finance management and processing are not precisely outlined. In that case, there might occur a misunderstanding about what entity is responsible for violating the regulations or rules. To prevent such situations, take care of the role distribution before bringing the project to life.

Another challenge is the conditions of the commercial relationships between non-financial and financial companies. Suppose that there is a non-financial company offering loan services via its platform. In this case, the financial institution under the roof has no data about the borrower or loan conditions. If the borrower violates the rules, the question arises about who should manage and resolve the conflict.

The financial company may be confused about how they can facilitate the processes when they have no information at hand. The situation gets even harder if their business model relies on two or more financial institutions.

Last but not least, there may be a challenge with API integration. The traditional bank of your choice may not be prepared technically to offer digital operations. Thus, you should carefully select the provider of financial services and make sure that your partner has enough capacity and security to cover your client traffic.

So, there exist a few challenges linked to embedded financing. However, those are minor and can be easily overcome with expert help. Here at Forbytes, we are aware of all the regulations and standards of fintech development so you can delegate the responsibility of launching a successful project to us. Discover how we help our customers achieve their goals in digital format.

Conclusion on the Prospects of Embedded Finance for Your Business

Considering all you’ve learned from this article, we can state that embedded financing has a big potential to disrupt the financial and fintech industry. Unlike traditional banking services involving many time-consuming processes, embedded fintech allows businesses to become a one-stop destination for their clients.

For customers, there is no need to switch apps, send payment confirmations from one company to another, spend time on payment processing, etc. They are provided with a precious opportunity to make use of the services and products and pay for them in one place that they trust and like.

If you want to join the list of companies transforming their business with embedded payments, consider hiring a fintech software development company. As a trusted software development partner, Forbytes can help you integrate financial services into your solution, ensuring great user experience and top-notch security for your clients.

Contact us to schedule a free introductory consultation.

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?