The banks are in fierce competition. The digital banking industry is subject to endless changes, quickly embracing digital financial technologies and focusing on offering more and better digital services to their clients. Credit assessment technology is rapidly changing the way companies approach lending. This technology is employed by an increasing number of banks and financial institutions to help evaluate credit risks.

In this article, you’ll learn what credit scoring software solutions are, what they offer to a bank’s financial performance, and why banks should incorporate them into their systems.

Digital Transformation of the Banking Industry

The changes in technology and business are occurring at a rapid pace. The banking industry is undergoing a digital transformation brought about by emerging technologies. It becomes more customer-centric, impacting the client journey and revolutionizing the relationship between them and a financial institution.

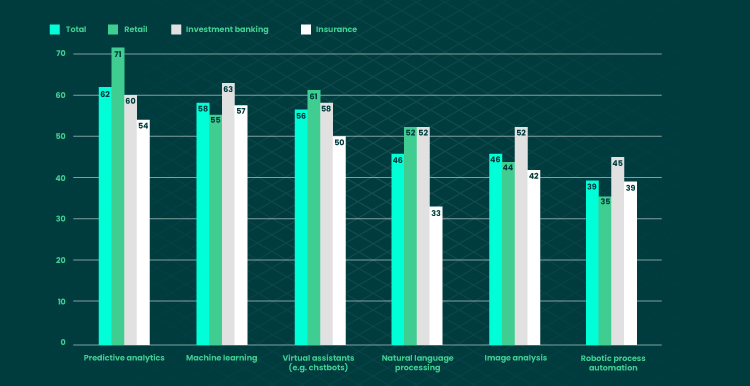

Banks and other financial service providers leverage powerful technology to manage data and stay competitive in the market. Technological adoption enables banks to cater to the needs of their customers more accurately and profitably. One of the most demanded tech novelties in finance is credit scoring systems based on AI and ML, often called alternative credit scoring.

Machine learning and AI have revolutionized the finance industry in recent years. According to research by Deloitte, 70% of all financial services institutions are utilizing ML to forecast money flow cases, adjust credit scoring, and identify forgery. Investment banking relies heavily on ML to adjust algorithms and prediction models to isolate risks.

What Is Credit Scoring Software?

Saving money and making effective financial decisions with credit cards, loans, and more is only possible with a good understanding of the audience. Globally changing demographic and economic circumstances have created a shift in the way banking institutions serve their customers. One of the solutions that have emerged has been the advent of credit scoring software.

Credit scoring software is data analyzing software used to process credit files in order to evaluate a person’s creditworthiness, eligibility for loans, credit cards, and buying behavior. Credit scoring software works by looking at historical patterns of loan usage, income, and other historical data to determine whether a potential borrower is in default or has an affordability gap. This can help banks judge whether to make a loan, whether there is a credit risk, etc.

In recent years, credit scoring software has been a key area of technology improvement in the financial sector. Banking platforms have become complicated, requiring large sums of money from depositors to continue serving risk-free. So they need to either take on the risk themselves or find a third party to which they can outsource the risk. This is where credit scoring comes in. Credit scoring software was created to determine the potential risk customers might pose to the bank.

What Is Alternative Credit Scoring?

While the traditional credit report has become obsolete in the digital era, new credit scoring alternatives are emerging with a focus on the customer’s digital footprint in social media and the effects of consumer choices on future creditworthiness. Alternative credit scoring evaluates a customer’s financial status by analyzing factors like income, debt, assets, and spending patterns.

Basically, alternative credit scoring is a tool that browses users’ social profiles and matches lending information to the applicant’s financial status. It creates a decision tree that the credit provider can leverage to determine the lender’s opportunities, risks, and costs from various customer scenarios. Alternative credit scores can help you get into the door of a potential lender. They provide another layer of credit scoring that is based on behavior rather than traditional patterns of bill-paying.

The following sources of alternative data deliver more valid credit scores:

- With a solid payment history, borrowers will have an easier time proving their ability to repay a loan.

- A good rental payment report can significantly bolster an applicant’s reputation and credit score and thus provide access to credits at better interest. (It’s better to verify the rent expenses with your landlord).

- If an applicant has any kind of property, it can elevate their chances of getting a loan.

- Consumer spending behavior and, therefore, their way of managing finance can be reflected in the transaction data report.

- If an applicant reports their spending and saving data to the bank, it can boost their chances to get the loan.

- Banks can improve a client’s credit score when analyzing smartphone data (transactions, paid subscriptions, revenues, and expenditures on social media).

Despite having their own shortcomings, these systems still have some key benefits to offer, and can certainly be beneficial for organizations looking to tap into the power of their data.

Why Traditional Credit Scoring No Longer Works

In the age where technology and the standard business systems are changing at a breakneck pace, traditional metrics and analytics are losing their efficacy and becoming less reliable. As a result, organizations must transition from legacy analytics and metrics to predictive analytics, which allows for a better understanding of trends in data and help anticipate changes to patterns that can be seen as opportunities for improvement.

Note: In the B2B and B2C spaces, obtaining credit is often a lengthy and complex process. This is due to the nature of the documentation at the jurisdictional level, and the way agencies and lenders need to authenticate and follow certain factors to apply. For example, auto loan applications often require a minimum credit score of 720 in the minimum credit analysis range, which, in turn, is determined by the credit report issued by the “big three” agencies of the U.S. This requires even more paperwork than the client had to go through before. With alternative scoring, this process can be much easier and speedier.

Traditional credit scoring is heading towards obsolescence due to innovations in data sharing that have been launched in recent years. The credit scoring industry is in a state of flux. The traditional approach to scoring creditworthiness as reflected in the FICO credit score no longer captures the complexity of modern financial transactions. Because conventional credit scoring systems are not in sync with the rest of the financial ecosystem, they can’t provide a reliable credit score.

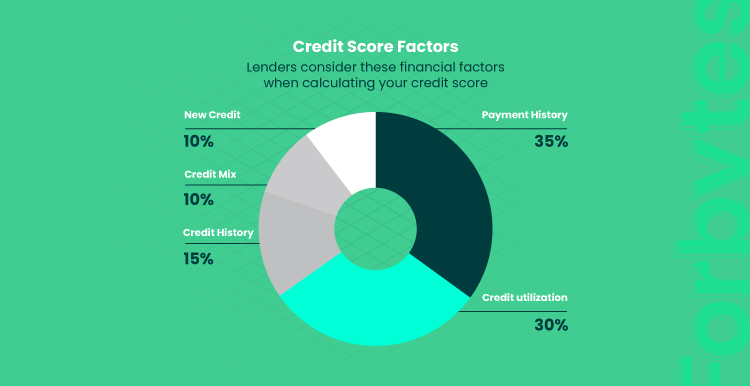

Credit scores used to be heavily based on credit history — a person’s past performance with credit cards, loans, and mortgages. However, after the recent economic downturn, banks and credit providers began to rely on social media, location, and behavioral data reports to piece together a person’s financial history. This means less weight is given to a person’s credit history, and more is given to a full picture of the financial activity of a person.

How Credit Scoring Software Can Assess Creditworthiness

Many background checks rely on the FICO score, which is the simplest and most widely used credit rating model. But FICO only looks at consumers’ credit history, not all of the other ways by which they might affect their score. This can lead to inaccurate risk assessments and missed credit risks, regardless of their habits.

Alternative credit scoring is a process that provides a credit report to a consumer free of the traditional “big three” credit reporting agencies that rely on FICO scores and similar scoring systems. Alternative credit scoring is the most accurate way to assess a user’s creditworthiness, utilizing the full picture of available credit history information.

To be more precise, alternative credit scoring is an algorithmically-based system that determines an individual’s creditworthiness. The goal of the system is to forecast default and bankruptcy risk within a tolerance level by using a single threshold to classify an individual. This approach presumes everyone can offer payment without fail and is much less individualized than traditional credit scoring. Alternative credit scoring software uses machine-learning algorithms that analyze historical credit data and data from other sources like social media to make data-driven decisions and predict the likelihood of a borrower’s ability to repay the loan.

Note: Your credit score is a statistical prediction of your ability to repay your debts. A credit score is a three-digit number, generally between 300 and 850, created to define your credit risk or the odds of paying your bills on time.

Credit scoring software was originally designed as a way to predict whether credit applicants would default on their loans. At the institution level, a growing number of lenders are now using credit scoring software to manage their portfolios, which has the potential to reduce loan defaults and borrower churn. The mortgage process has many moving parts and a ton of manual work. But with the help of credit scoring systems, the lending process became easier for everyone involved.

How AI and ML Can Improve Credit Risk Assessment

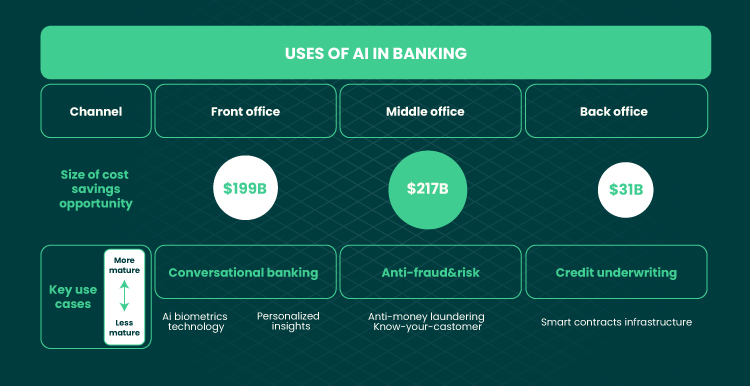

Traditional statistical algorithms are slow and inaccurate, and the need for speed and accuracy has led to the widespread adoption of Artificial Intelligence (AI). Machine learning and AI can have a significant impact on the credit risk assessment space and help businesses reduce the risk of default while creating a better customer experience.

Smart credit risk modules, based on machine learning and AI, analyze gender and age, the owner’s credit history, and more from the Internet, data centers, social media, and other sources. Artificial Intelligence is the best at identifying patterns among sets of data. With time, this technology can predict if a particular set of data is harmful and should be avoided for credit risk assessment. Besides, AI and ML analyze the data much better and faster than humans. The accuracy of this fundamental process is of utmost importance for the financial industry and for the millions of individuals involved in it.

Smart credit scoring is the holy grail for fraud protection in the digital era. The more we mine for data, the smarter these systems will become, but these advances can be costly. Banks now leverage AI and ML to create a credit scoring algorithm that brings more transparency and peace of mind to the way your credit score is calculated. This is done in a way that mimics the way a human would make a decision, only for it to be much faster and more accurate.

Credit Scoring Software Benefits

Credit scoring software creates a credit rating by analyzing data pertaining to a person’s finances. This data is compiled from personal and financial transactions taken from an individual over a certain period of time, and an algorithm is created from these data points to produce a credit score. Using a tool like this is a big step towards understanding your customer’s creditworthiness.

If you’re considering using credit scoring software in your business, you may be interested in the main benefits of using it alongside other tools. The utilization of credit scoring software is a good way to:

- improve the quality and accuracy of financial lending;

- help lenders provide credit to more borrowers;

- empower clients to make better financial decisions;

- optimize workflows between a creditor and a client;

- speed-up credit risk scoring process.

The idea of optimizing workflow between a creditor and customer lies in removing friction through automation thereby improving customer experience. That is exactly what novel technology was created for.

Alternative credit scoring offers a near-perfect methodology for checking someone’s credit score and offers a score prediction. It is becoming a favorite tool among consumers who want to understand their personal credit score better and predict what they might be able to afford in the future. By simply uploading a copy of their last pay stub, previous month’s bank statement, and a recent credit card statement, the software can review your data and compare it to its own proprietary database of millions of consumer credit.

Credit Scoring Software Implementation

Credit scoring software implementation processes can be complex and time-consuming. Therefore, it is recommended that businesses consult a service provider before working with new software. If you still want to accomplish that on your own, we’ve compiled a list of to-dos and developed a plan to make the process easier for you.

So, start with the following steps:

- define the final goals you want to achieve with your credit scoring software solution;

- make sure there’s enough consumer data at your disposal;

- gather a team of AI and ML professionals for deep-data analysis.

You will have to divide the software implementation process into several separate phases. Generally, there are six of them:

- Combine internal and external data to form a statistical analysis model.

- Measure the possibility of defaulting by rationing clients’ risk classes depending on their incapacity to repay debts on time.

- Determine thresholds based on the default possibility ranking, develop a strategy you’ll employ if a client is in a risk category, risk class, and establish a clear decision-making routine for risky clients.

- Use backtesting – a vital component of implementing alternative credit scoring solutions. It confirms that the process meets the goals you’ve set based on customer data and provides crucial insights on what needs to be improved.

- Make sure that your newly-installed software is aligned and ready to operate as your risk management solution.

- Last but not least, document and store all customer-related information and payment data to maintain the technical and statistical support of the credit scoring model and assess risks in the future.

Final Word

Today, more and more finance firms are relying on new, more diverse tools to assess the creditworthiness of new clients. The use of artificial intelligence (AI) and machine learning (ML) is the future of credit scoring. The way companies use it plays a huge role in helping them determine the creditworthiness of individuals. Alternative credit scoring solutions can help manage a company’s credit risk and save time using data-driven models.

Many companies are still learning how to incorporate this technology into their strategy. We are happy to provide our assistance in this field. We, at Forbytes, work with a credit score niche to help develop easy-to-use, scalable, custom-built credit scoring systems. We work with many clients and startups who are considering or in the process of implementing credit scoring software in their business.

If you’re thinking about incorporating novel solutions and developing advanced apps for your company, we are at your service!

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?