The ability and readiness of banks to implement AI-powered technologies into daily operations will determine if they are successful or are doomed to failure. AI in banking has the potential to transform user experience, automate many time-consuming tasks, drive insightful data analytics, and boost operation efficiency.

Many experts claim that this powerful technology will shape the future of banking. By 2030, AI will save more than $1 trillion for banks and financial institutions, motivating the latter to invest in smart fintech technology.

In this article, we will look at the key applications of artificial intelligence in banking, discuss the limitations and challenges companies should cope with, and share our guidelines for launching your first AI banking project.

The Impact of AI on the Banking Industry

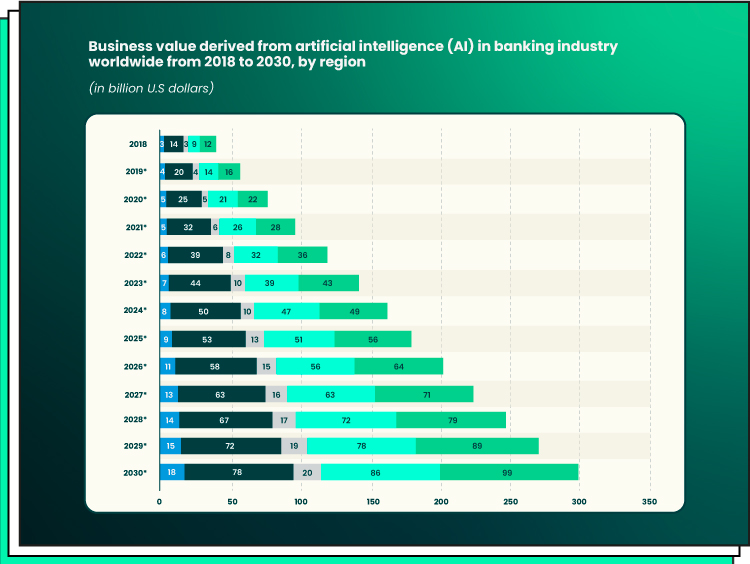

AI implementation is no longer the goal for the future, but the reality grasped by both established banking businesses and growing fintech companies. AI in banking is implemented worldwide, with North America and Asia Pacific having the biggest market share. This chart by Statista demonstrates the growing market value of banking AI from 2018 to 2030.

In each of these regions, AI is becoming the tool for achieving better efficiency, process automation, business effectiveness, better productivity, and more. The benefits that artificial intelligence banking brings give companies a competitive advantage and help them make essential breakthroughs in improving user experience.

AI makes the finance-related processes more personalized, insightful, and quicker. What took hours for an employee to do, now takes minutes and even seconds for AI to complete. Because of the power to cut the workload and costs, many people tend to fear that AI is becoming a threat to people’s roles at work. However, this fear is needless. As our experience with AI integration demonstrates, the current stage of technological growth does not allow machines to become independent and self-controlled. Although the AI bank can take over a lot of work done by humans, it still needs human guidance, control, and management.

Thus, AI frees up a lot of time for an employee, but it also assigns many new responsibilities and roles to them. They can devote more effort to goal-critical jobs instead of completing mundane tasks. What’s more, the use of AI in banking can help them make their work more insightful and effective. Let’s check how artificial intelligence impacts the banking industry by reviewing the three instances below.

AI and banking data

Humans have limited capabilities for manual data analysis. The banking and financial industry are known for the wide coverage of the audience, which requires their specialist to work with big volumes of data. This, in turn, makes it close to impossible to analyze all this data manually and draw insightful conclusions. This is where AI comes into place.

Artificial intelligence in banking can collect and analyze vast amounts of customer data and conclude on each user’s preferences and service needs. This data is then used by AI to automatically personalize banking services and address their specific needs in real-time. The future of banking is promising if banking institutions implement AI-powered service customizations, personalize product recommendations and notifications, and offer AI-powered 24/7 client support.

AI and banking workload

The implementation of AI in banking can also increase automation for banking and financial institutions. The tasks usually done manually can be assigned to the machine. For example, password resets, report generation, financial inquiries, etc. can be done by AI while customer support representatives can solve more complex challenges. By investing in AI, banks can make customer support more responsive and helpful, ensuring 24/7 access to it for their clients.

AI and user experience

The use of AI in banking paves the way to ensuring a transformational user experience. In the form of a conversation, users can interact with an AI-powered LLM (large language model) and use it to complete various actions in their bank accounts. Instead of looking for the right button or feature, a user can ask the machine to do the action for them in a few seconds.

For example, they can check their balance, make a transaction, get reporting data, set customized reminders or notifications, and more. By integrating AI into banking and finance operations, companies can significantly streamline user experience and reduce the complexity of fintech operations. This, in turn, will help them easily attract new audiences, preventing situations when new users feel confused about how to use the bank’s app or website.

As a professional AI development and integration company, we have experience working with trendy Large Language Models like ChatGPT and others. Our AI bank development team can help you integrate conversational AI service into your solution and configure it to serve your user needs.

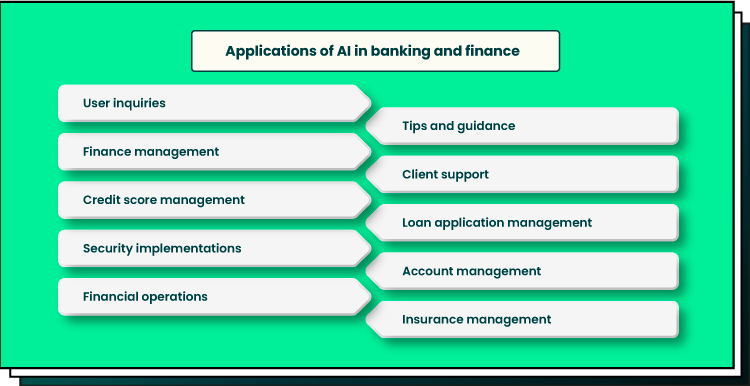

10 Implementations of Artificial Intelligence in Banking

Let’s review the top 10 use cases of artificial intelligence banking. From better client service to operation efficiency, AI can transform the way banks deliver their services.

User inquiries

Instead of looking for some button or feature manually, a user can ask AI questions and get answers in conversational mode. For example, they want to know their account balance or generate reports on their expenses. Instead of going through an extensive user flow to complete these actions, a user can refer to banking AI and instantly get all the data. This saves the user time, decreases the effort needed to make an inquiry, and increases the convenience of services.

Finance management

AI can also be used by clients to facilitate their financial planning. By asking the chatbot, a client can learn more about growing investing trends, financial opportunities in their sector, and more. In this regard, AI in banking will serve as a free financial advisor, giving the bank more competitive power.

Credit score management

The AI bank can also help with credit score monitoring. Banks and financial institutions create AI-powered chatbots that clients can use to check and improve their credit ratings. Anytime, they can refer to the chatbot to get advice on how to repair their credit scoring.

From the company’s side, AI-powered tools can study big volumes of financial data, including transaction data or credit scores, to detect credit risks at early stages, preventing financial losses for a company.

Security implementations

AI can be used to increase security. AI can analyze the activity in bank accounts and automatically notify users if some suspicious actions are detected. Also, AI technology can be implemented to request and process confirmations of actions.

Combined with other security measures, AI in banking can protect client data and finances from breaches. If you’re interested in other ways to increase security in fintech, check out our recent article on biometrics in banking, its key applications, and the benefits it brings.

Financial operations

Users can use AI-powered chatbots to enable finance-related operations. For example, they can ask the AI to do a money transfer to someone else’s account or their accounts. They also can ask the chatbot to complete payments when making orders online. Instead of typing in the payment details manually, users can delegate this responsibility to AI and save time. Besides, AI can generate and send payment recipes to merchants as confirmation of the operation.

Tips and guidance

AI-powered chatbots trained with big volumes of data can also serve as a source of advice for clients. For example, they can ask the chatbot to give them tips on how to improve their finance management.

Also, they can use banking AI to get access to insightful analytics on their sources of income, critical expenditures, etc. By checking this information, they will be able to optimize their finances and make more informed decisions in the finance & banking sector.

Client support

AI-powered chatbots can be implemented by banks to ensure high-quality customer support 24/7. First, a user will be referred to artificial intelligence to solve their query. In case AI cannot help, a user will be connected to a human assistant.

Such a strategy will save a lot of employee time that is usually spent on mundane tasks and questions. Besides, client satisfaction rates will rise since they will get responses to their questions quickly.

Loan application management

Applying for a loan can be a tedious process for clients, and so it is for banks reviewing the candidate’s applications. AI can streamline this process for both parties and here is how. AI banking chatbots can be the starting point for a user applying for a loan. By answering the automated questions, AI will define if a user’s application corresponds to the demands and requirements. Only after AI checks the application, it goes to managers for a human review.

From the customer’s side, the use of AI will also be beneficial. They can refer to the chatbot for guidance and information concerning the loan application. Anytime, they will be provided with support and tips on how to facilitate the process.

Account management

Artificial intelligence banking can be trained to help users manage their accounts. For example, a model can be taught to set automatic payments, send notifications when it’s time to make payments, change details in bank information, and more. Instead of asking managers to do it manually, clients will use the technology, making the process more efficient and stress-free.

Insurance management

It takes a lot of time for a client to make an insurance claim. What’s more, this process is typically accompanied by a lot of paperwork and numerous checks.

To streamline this process for both banks and customers, companies can implement AI chatbots. With this solution, users will get the claim procedure checklist, make sure they comply with the rules, and submit their applications.

The Future of Banking: Key Challenges Faced by AI Adopters

Despite the benefits AI brings to the banking industry, its implementation also poses some challenges for companies and organizations willing to make the most out of tech innovations.

The first challenge worth your attention is the security of client data. Security of banking data and operations is a top priority for this industry. When integrating banking services with third-party AI solutions, companies open access to their client data. This is why the AI-powered solution should be wisely chosen by a professional team experienced in AI development. What’s more, banks should ensure that the interface they use to connect their apps with AI is secure and that user data, as well as finances, are protected by additional security measures.

The next challenge is preparing the AI model to serve the banking industry. The banking and finance sectors have their own terminology and context. Before integrating AI with banking services, it’s important to train the technology with relevant and up-to-date data. Lack of effective training can result in AI providing insufficient answers to queries.

To prevent such situations, it’s important to prepare AI for the peculiarities of work in fintech. At Forbytes, we offer a wide range of AI development and integration services. We work with the best AI models on the market and integrate them with our clients’ services to automate many processes and improve business outcomes. Below, you can see what we have to offer.

Last but not least, it may be challenging for banks to encourage customers to start using AI-powered services. Clients may be unaware of the benefits and convenience that AI may bring. This is why it’s important to create an appealing and intuitive user interface that will grab user attention and demonstrate all the opportunities one can get with an AI bank.

Ready for AI implementation?

We’ve always been a company driven by tech innovations and advancements. Today, we see the great potential of AI to disrupt the finance & banking industry. Having more than 12 years of experience in software engineering and integration, we can help you with integrating AI services into your solution.

Contact us to meet our team and tell us more about your plans for the project. In our turn, we will share our view of the way to bring your idea to life in accordance with your goals, timing, and budget.

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?