Handling payments is one of the trickiest parts of steering a business. You may have late invoices, high transaction fees, or payment errors that take hours to fix. Tracking money across different systems often adds even more stress. These problems slow down cash flow and make it harder to focus on running your company.

Payment apps can solve much of this. The right tool helps you process payments faster, keep better records, and reduce mistakes. It also makes it easier for your customers to pay you directly into your banking account, so you get money in the bank quicker.

You can find many options on the market stall. Stripe is the go-to choice for online businesses that need global payments and advanced API integrations. PayPal has a long track record and gives you a simple way to invoice and accept payments worldwide. If you want contactless checkout, Apple Pay make transactions quick and secure.

The hard part is to know which money transfer services are right for your business. Some are too complex, while others don’t offer enough features. Fees can also vary, and the wrong choice can add unnecessary costs.

This article will save you time. We’ll look at the top payment apps for companies and show you what each one does best so you can choose the system that works for you.

What Are the Main Types of Payment Apps?

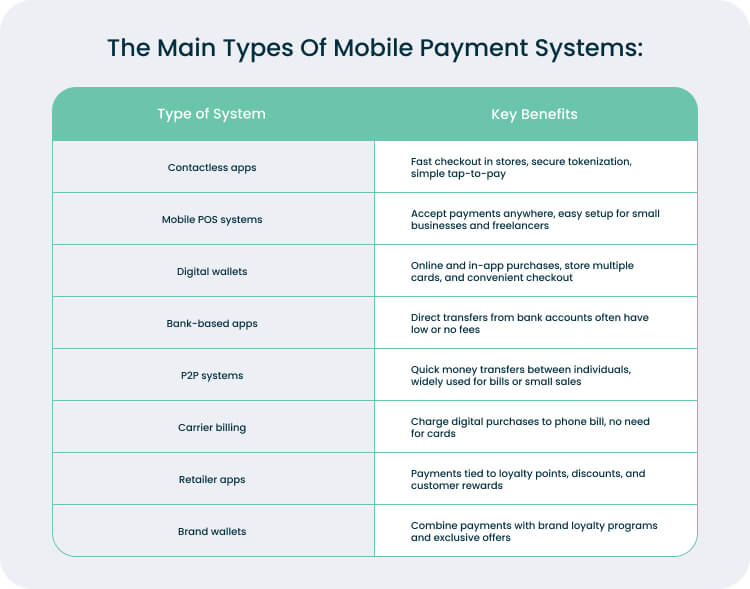

Payment apps fall into a few main categories. Each works differently and is better suited for specific situations. For example, contactless payments are popular in busy stores because they are fast, while peer-to-peer (P2P) systems make it easy to split a bill or send money to friends.

Here are the main types of money transfer apps:

Proximity payments

- Contactless apps: Use NFC or RFID technology to complete a payment when a customer taps their phone against a POS terminal. Apple Pay and Google Pay are widely used at retail checkouts, offering the same convenience as tapping a debit or credit card.

- Mobile POS systems: Portable point-of-sale devices that connect to a smartphone or tablet to accept payments anywhere. For example, Square lets small businesses accept card payments with a mobile reader.

Remote payments

- Digital wallets: Money transfer apps like Apple Pay or Samsung Pay store card information and allow online or in-app payments. Many ecommerce platforms accept Google Pay as a quick checkout option. Users can also send money instantly to friends, family, or businesses, making these apps versatile beyond shopping.

- Bank-based apps: Mobile apps from banks that let customers pay directly from their linked bank account. Zelle in the U.S. and Revolut in Europe are widely used for this purpose.

- P2P systems: Services such as Venmo, PayPal, and Cash App allow quick transfers between individuals. Venmo is often used for splitting bills among friends, while PayPal is common for online transactions.

- Carrier billing: A method where purchases are added to the user’s mobile phone bill. Google Play and Apple App Store allow mobile carrier billing for app purchases. At Forbytes, we rebuilt Guesty’s billing system for integration with Zuora, ensuring seamless payment management and scalability.

Closed-loop payment systems

- Retailer apps: Systems created by retailers to accept payments, provide discounts, and manage rewards. The Starbucks app lets customers pay, collect loyalty points, and access special offers.

- Brand wallets: Payment apps created by brands that combine payments with loyalty tracking. Walmart Pay allows in-app payments while linking to rewards and discounts.

Choosing the right digital wallet is not just about convenience. It affects how quickly you transfer money, how much you spend on fees, and how smooth the experience is for your customers. With so many options, the best choice is the one that fits your business needs.

Need help deciding? We can guide you through the options and help you choose the cash app that works best for your company.

What Are the Best Money Transfer Apps for SMEs?

Small and medium-sized enterprises (SMEs) need flexible, secure, and cost-effective ways to receive money. The best approach is often to offer a mix of payment transfer services, from mobile apps to digital wallets and POS systems. So, customers can choose what works for them.

Here are the top payment transfer apps and online options for your business:

PayPal

Overview: PayPal lets businesses transfer money online, link to a bank account, accept payments in multiple currencies, and manage transactions securely. It works for ecommerce, invoicing, and peer-to-peer transfers. It’s also widely used for international money transfers, making it easier for businesses to operate across borders.

Features:

- Online payments

- Recurring billing

- Invoicing

- Digital wallets

- Integration with Shopify, WooCommerce, and Magento

- Fraud protection

- Buyer and seller protection

- Multiple payment options (credit card, bank account, PayPal balance)

Strengths: PayPal is widely trusted and easy to set up. It allows businesses to receive money easily and makes money transfers simple, thanks to integrations with ecommerce and accounting tools. Fraud prevention and purchase protection give confidence to businesses and customers.

Weaknesses: PayPal’s transaction fees can be high for small or international payments. Accounts can be limited or frozen if unusual activity is detected. Customization and advanced features are more limited than on platforms like Stripe.

Best for: Small-to-medium businesses, and online shops that need a reliable, easy-to-use payment solution with global reach.

Stripe

Overview: Stripe is an online payments platform that helps businesses accept and manage payments. It works for ecommerce, subscriptions, marketplaces, and in-person transactions, making money transfer smooth and secure through integrated POS systems.

Features:

- Online payments

- Recurring billing and subscriptions

- One-time payments

- Multi-currency support

- Integrations with ecommerce, accounting, and invoicing tools

- Fraud detection

- Security compliance

- Developer-friendly customization

Strengths: Stripe is highly flexible and developer-friendly. Businesses can customize checkout flows, manage multiple payment types, and scale easily as they grow. Security and fraud prevention are built in.

Weaknesses: Stripe can be complex for non-technical users. Advanced features often require coding or developer support. Pricing is less transparent than flat-rate alternatives, which may be confusing for small businesses.

Best for: Startups, growing businesses, online marketplaces, and any company that needs a scalable, flexible payment platform with strong developer support.

Square

Overview: Square is a payments platform that helps businesses accept and manage payments both in-person and online. It works for retail, restaurants, service providers, and small businesses of all kinds, making money transfer fast and secure.

Features:

- Mobile POS

- Invoicing

- Online store integrations

- Inventory management

- Payment analytics

- Credit and debit card payments

- Contactless wallets (Apple Pay, Google Pay)

- Online transactions

- Reporting tools for sales and customer behavior

Strengths: Square is easy to set up and use. This all-in-one solution covers in-person and online payments. Businesses benefit from integrated tools for inventory, sales reporting, and analytics. Customers can also send money quickly through Square’s peer-to-peer features, adding extra convenience.

Weaknesses: Some advanced features require paid subscriptions. Online transaction fees are higher than those of some competitors. International support is limited compared to global platforms like Stripe or PayPal.

Best for: Small businesses, retail shops, cafes, and service providers that want a simple, all-in-one payments solution with strong in-person POS support.

Google Pay

Overview: Google Pay is Google’s digital wallet and payment platform, supporting in-store, online, and in-app purchases.

Features:

- Tap-to-pay

- Online checkout

- Loyalty card and ticket storage

- Integration with Google services

Strengths: Convenient for Android users, works across channels, supports rewards programs, and simplifies reporting through Google’s ecosystem.

Weaknesses: Adoption varies by region and platform. Limited for users outside the Android/Google ecosystem.

Best for: Businesses targeting Android users and regions where this service adoption is high.

Apple Pay

Overview: Apple Pay is Apple’s mobile payment and digital wallet service that enables users to make secure transactions using an iPhone, Apple Watch, iPad, or Mac.

Features of Apple Pay:

- Contactless tap-to-pay

- Online and in-app payments

- Loyalty card and ticket storage

- Integration with Apple services

Strengths: Apple Pay is secure, fast, and convenient for Apple users. It supports online, in-app, and POS payments. No card details are shared with merchants.

Weaknesses: The solution only works for Apple Pay users, so its adoption depends on your customer base. Some advanced features may also require hardware investment.

Best for: Businesses with a strong Apple-using customer base that value speed, security, and seamless integration with Apple Pay.

What Technology Powers Payment Apps?

Now that you know the main cash apps on the market, it’s time to look at the technologies that power them. The speed and security of your payments depend not only on the app you choose but also on the technology behind it. Here’s a list of key technologies to keep in mind when deciding which app works best for you:

- NFC: Enables tap-to-pay by linking phones with payment terminals

- APIs: Connect your cash app with banks and payment networks

- Digital wallets: Store credit or debit card details or link directly to a bank account on phones for card-free payments.

- Encryption & tokenization: Secure data by hiding real card numbers

- QR codes: Payments start by scanning a code with a phone

- SMS payments: Transactions via text for areas with limited smartphone access

- Cloud payments: Store data in the cloud for access from any device

- Biometric verification: Use fingerprint or face ID for extra security

Together, these technologies enable customers to send money, shop online, and pay in stores directly from their mobile devices.

If you’re looking to implement them, get in touch with us as our team is ready to help.

How to Pick the Right Payment App for Your Business

Choosing the right payment methods is a big decision. Customers need convenience. You want fair costs and simple systems.

Start with your audience. Research what they prefer. Younger customers may lean toward Apple Pay or digital wallets. Elder ones often stick with a credit or debit card.

Offer more than one option. This way, you make payments easy whether you sell online, in-store, or both. Also, think about your experience. Pick a cash app that’s affordable, simple to use, and integrates well with your current tools.

Consider these factors when choosing a cash app for credit card processing:

- Payment methods: Estimate how many credit card sales you expect for in-person transactions, such as Apple Pay tap-to-pay, QR codes, pay links, or major credit cards. Decide if you also need options for bank account transfers, recurring invoicing, or online payments.

- Mobile payment hardware: Determine if you will use a smartphone with a mobile card reader, need portable terminals, or want a solution that works with third-party devices. Make sure your setup allows you to easily receive money from all payment types.

- Virtual terminal features: Compare POS and payment features for invoicing, receipts, customer management, and sales tracking.

- Scalability: Check how many users can process credit card payments simultaneously. Ensure the software can grow with your business, whether by adding POS hardware or new sales channels.

- Support and payouts: Review the vendor’s terms, fund transfer schedules, reasons accounts might freeze, and customer service options to ensure you can reliably receive money when you need it.

Challenges of Integrating Payment Apps and How We Solve Them

Mobile payments make transactions faster and more convenient, but many businesses face hurdles when adopting them. Our team helps companies address these challenges to ensure a smooth and secure payment experience.

- Security concerns. Mobile payments can be exposed to risks like data breaches or hacking. We implement PCI DSS–compliant systems, encryption, tokenization, and multi-factor authentication to protect your customers’ bank account information and other sensitive data.

- Technology and infrastructure investment. Setting up a cash app often requires new POS systems and staff training. We provide scalable solutions and phased implementation to optimize costs and minimize disruption.

- Fraud management. Digital payments are always at risk of fraud. We apply real-time monitoring, AI-based detection, and verification procedures to prevent unauthorized transactions.

- Customer privacy. Managing sensitive data requires extra care. We ensure compliance with GDPR and other regulations, secure data storage, and support transparent policies that build customer trust.

- User adoption. Some customers hesitate to switch to a cash app. We help businesses educate their users, highlight security and convenience for every linked bank account, and design simple interfaces and incentives to drive adoption.

With our support, you can overcome the five biggest barriers to mobile payments and deliver a solution that’s safe, simple, and effective for your business.

Make Mobile Payments Work for Your Business with Forbytes

Mobile payments can boost convenience, speed up transactions, and improve customer satisfaction. But to get the full benefit, you need to focus on three key areas: security, technology, and customer needs. Make sure every transaction links securely to a bank account to protect both your business and your customers.

Implementing mobile payments doesn’t have to be complicated. Start with scalable solutions, train your team, and educate your customers. Ensure each payment links securely to a bank account, monitor transactions, stay compliant with regulations, and prepare for technical issues. These steps help reduce risk and build trust with your customers.

Our team at Forbytes can help you implement a secure, flexible money transfer services tailored to your business. Contact us to make payments simple, safe, and seamless for your customers.

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?

Our Engineers

Can Help

Are you ready to discover all benefits of running a business in the digital era?